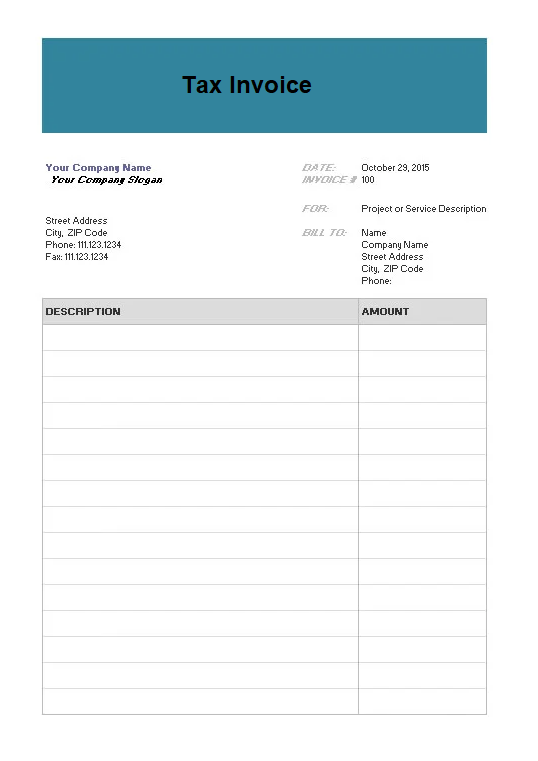

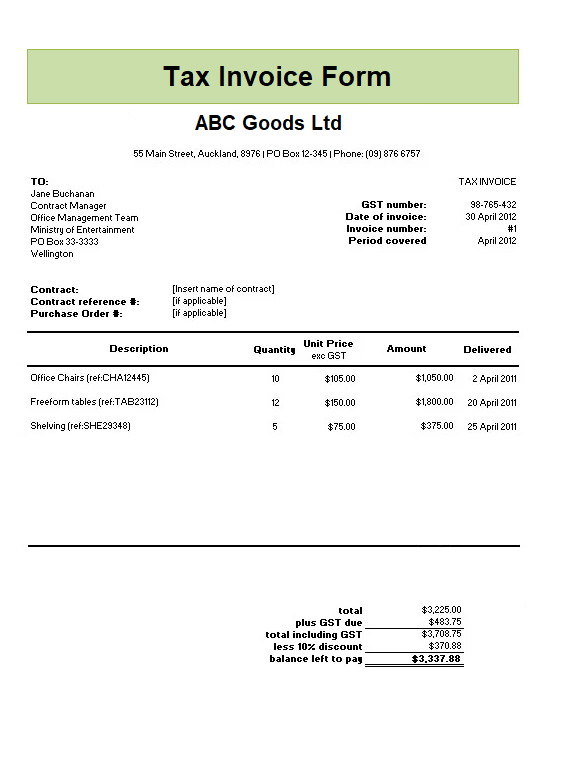

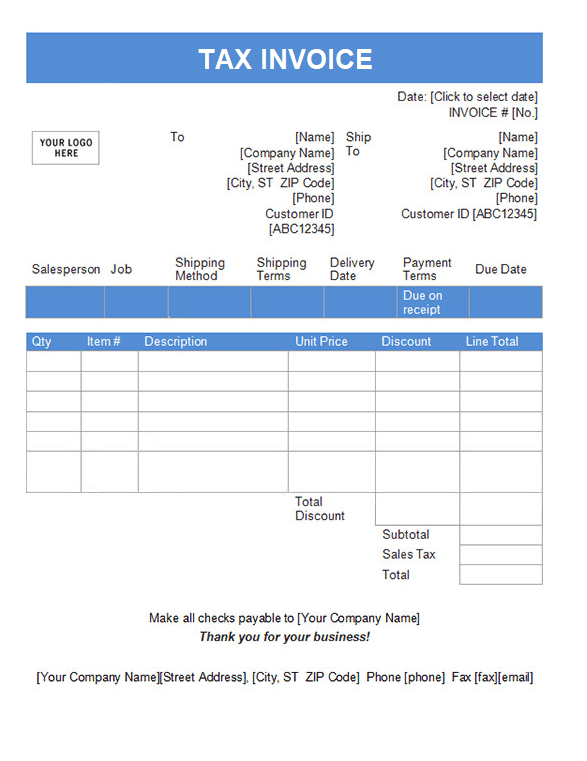

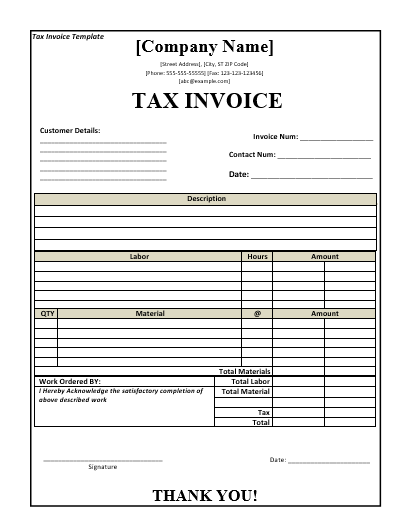

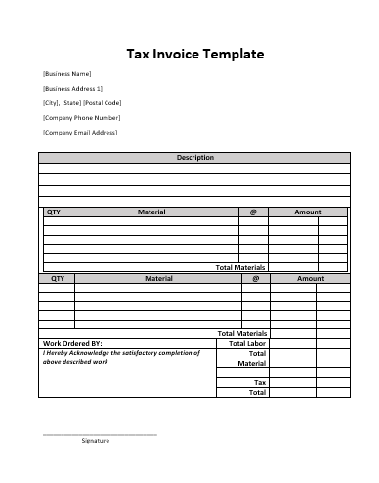

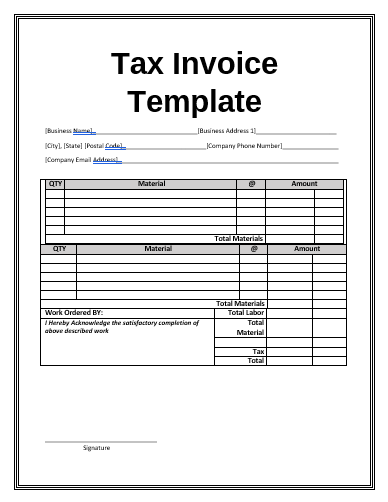

A tax invoice template is legal evidence that a certain amount of tax is deducted from taxable supplies or materials such as advance tax, sales tax, commercial tax, general sales tax or any other value added tax (VAT). The purpose of deducting tax from the amount is because of a compulsory requirement by state or tax authorities and this amount must be deposited into the state account for settlement of tax in the annual return. In the description section of the invoice, these details must be provided by the seller or through rapping around the product. A registered seller must have a separate account for the collection of the tax amount deducted from taxable supplies during the described time frame and then deposit it while filing in return. It is a slip which is entirely based on proof against cash and credit transactions under the statement of taxes. These free invoice templates are used by organizations as a payable difference containing document where individuals can show the difference between the output tax and input tax. No matter for what purpose you are preparing a tax invoice, as a company you should always need to add details of all the transactions on the invoice directly below the expression of taxes.

Check our free blank invoice templates.