A sales ledger template is a detailed account referring to sales transactions either on cash or credit, made by an enterprise or business during a certain period of time. Like a purchase ledger, a sales ledger can contain elaborative details of the transactions made for sales of the products and services offered by the company. All the information added to the sales ledger is eventually posted to the general ledger and from there the financial analysis of a company can be done. The transfer of the financial data from the sales ledger to the sales account in the general ledger can be done at certain intervals as per the company’s record-keeping policy and the nature of the business. However, the data that gets posted in the general ledger is not as detailed as the one in the original source, that is, the sales ledger. So, basically, the general ledger contains only the highlights of the sales transactions made for a specific amount of time.

Components of a Sales Ledger:

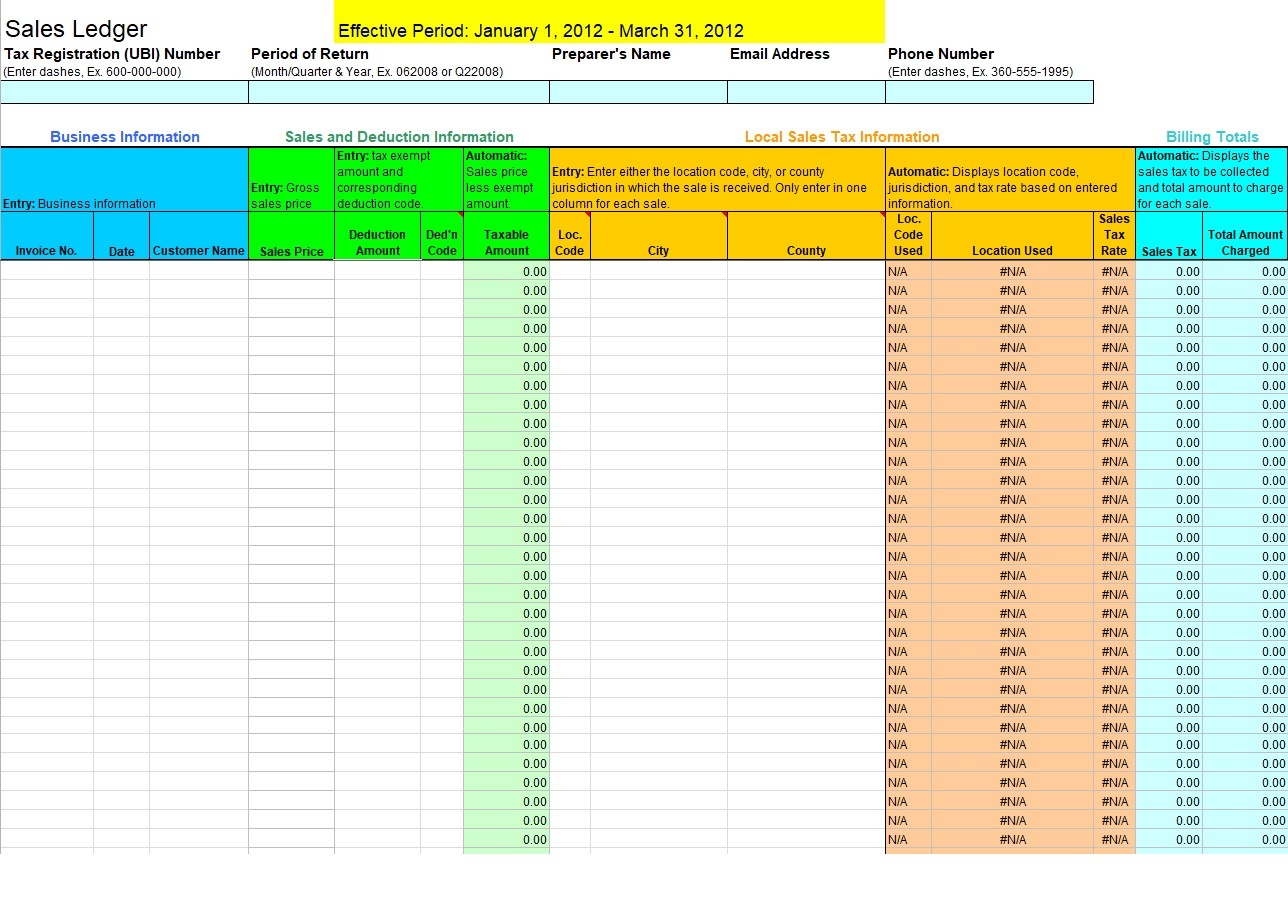

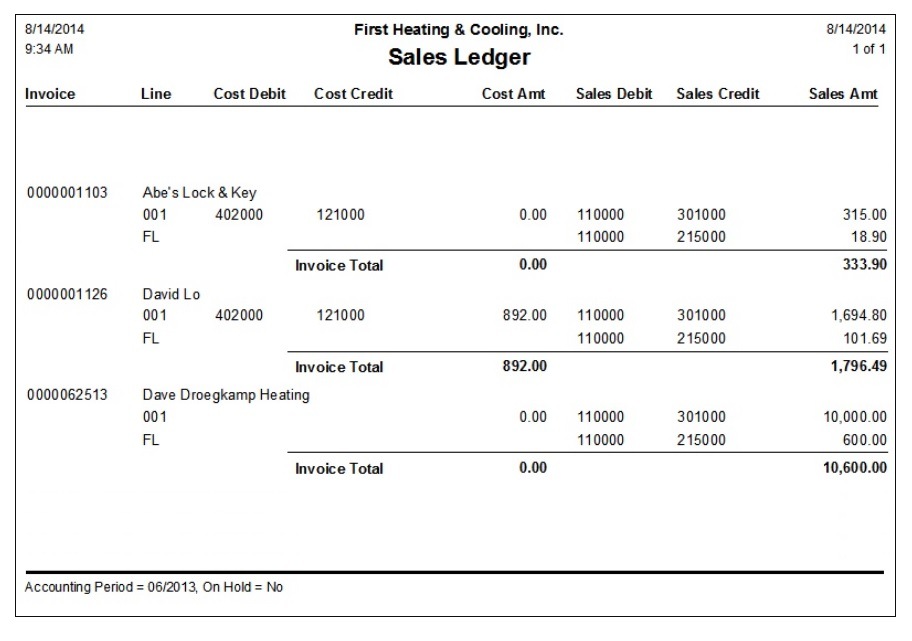

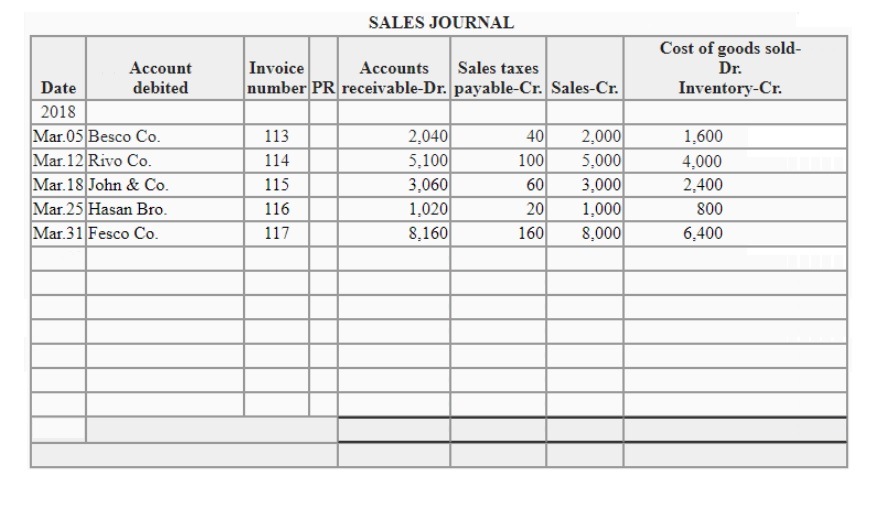

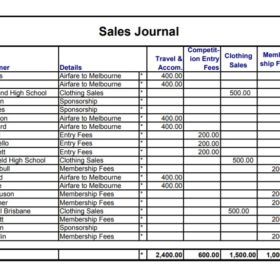

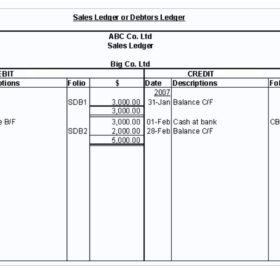

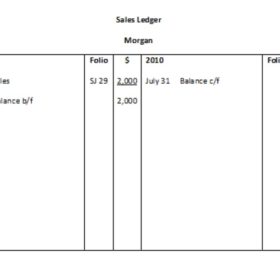

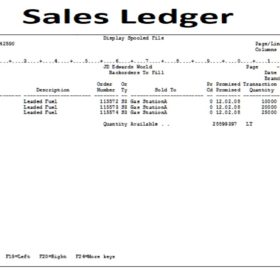

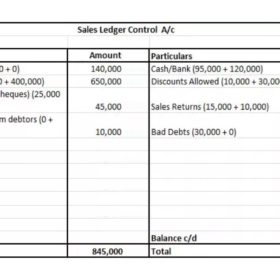

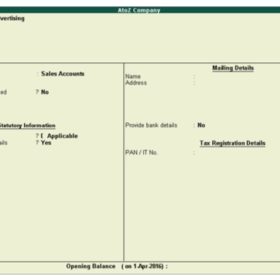

For ease of accessibility, the sales ledger is divided into columns and rows. The major components of a sales ledger include a list of the items sold, date and preferably the time at which the sale was made, invoice number, item identification code, sales amount, sales tax, discounted amount in case there was any, value-added tax, credit notes if there were any, name or company name of the customer. Alongside keeping a record of the sales made on which the payment has been made by the customer, a sales ledger additionally keeps a record of the sales made that have not been paid yet. This gives an account of the company’s net balance that is not in the account yet, but it can be calculated as part of the total sum.

Advantages of a sales ledger:

A sales ledger might not seem of much importance to employees who have recently started their startup venture, but as they make sales and numerous invoices are generated, that is when the sales ledger comes in handy. There are a number of benefits that a sales ledger may harvest for an enterprise. First and foremost, benefit is being that a sales ledger makes the process of auditing convenient. With all the company’s sales records accumulated and arranged in a single place, it becomes unchallenging to draft the audits. As mentioned earlier, all the company’s sales records are kept in the ledger. A few customers request to pay later instead of paying in advance, or they wish to pay in installments. These financial sales records are called accounts receivable and are kept under a separate category. This further makes it easier for the financial management authorities to reach out to the clients and demand the amount payable.

Details of a sales ledger:

A sales ledger template can be done as a data basis for research regarding which products sell more and what kinds of clients are interested in what services or products. Such information proves extremely valuable while planning future marketing strategies and target audience. It also gives a bigger and a clearer picture of what product has been a success in a specific niche of the client’s market. All in all, a sales ledger could actually help a business design its future strategies and layouts around the data collected over the period of a few years. Just like other accounting tools, a sales ledger template is easy to find, and it can also be customized to further meet the requirements of the company that it is being used for. Businesses, large or small, are often required to formulate and present their financial statements in order to deal with certain legal matters. In that case, these sales ledgers come in handy and are easy to assess all the transactions.