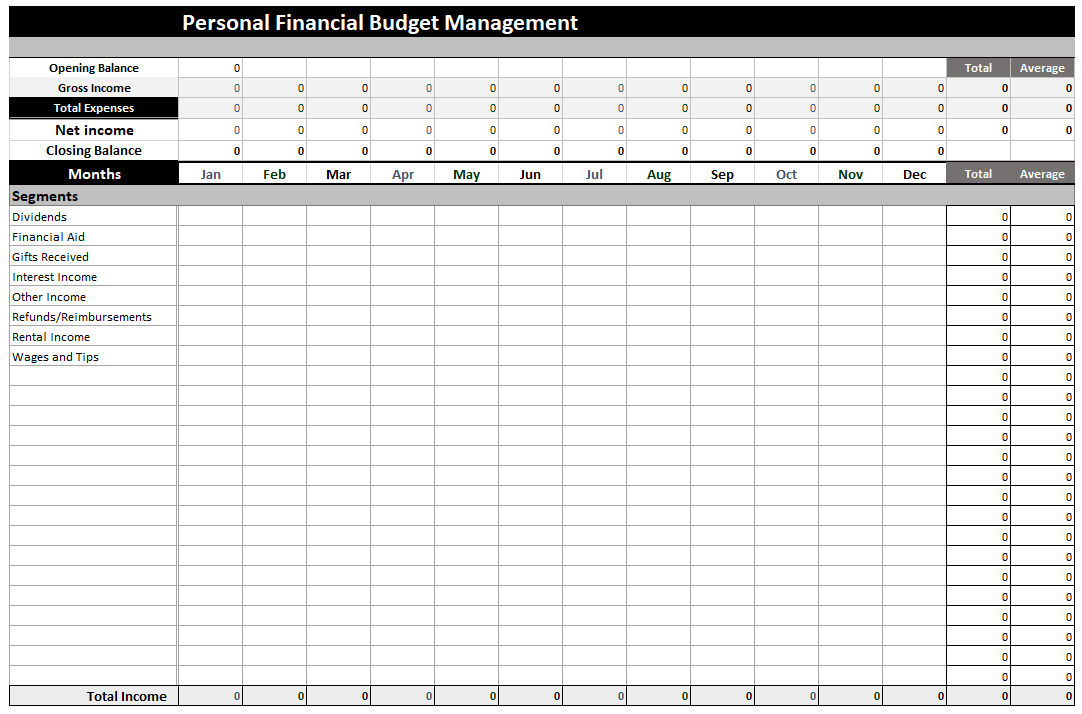

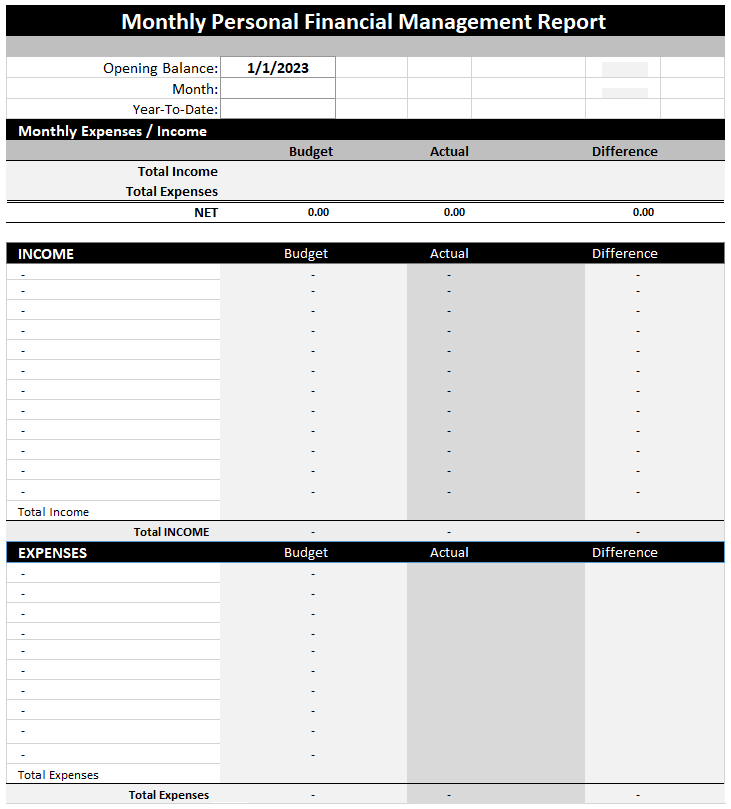

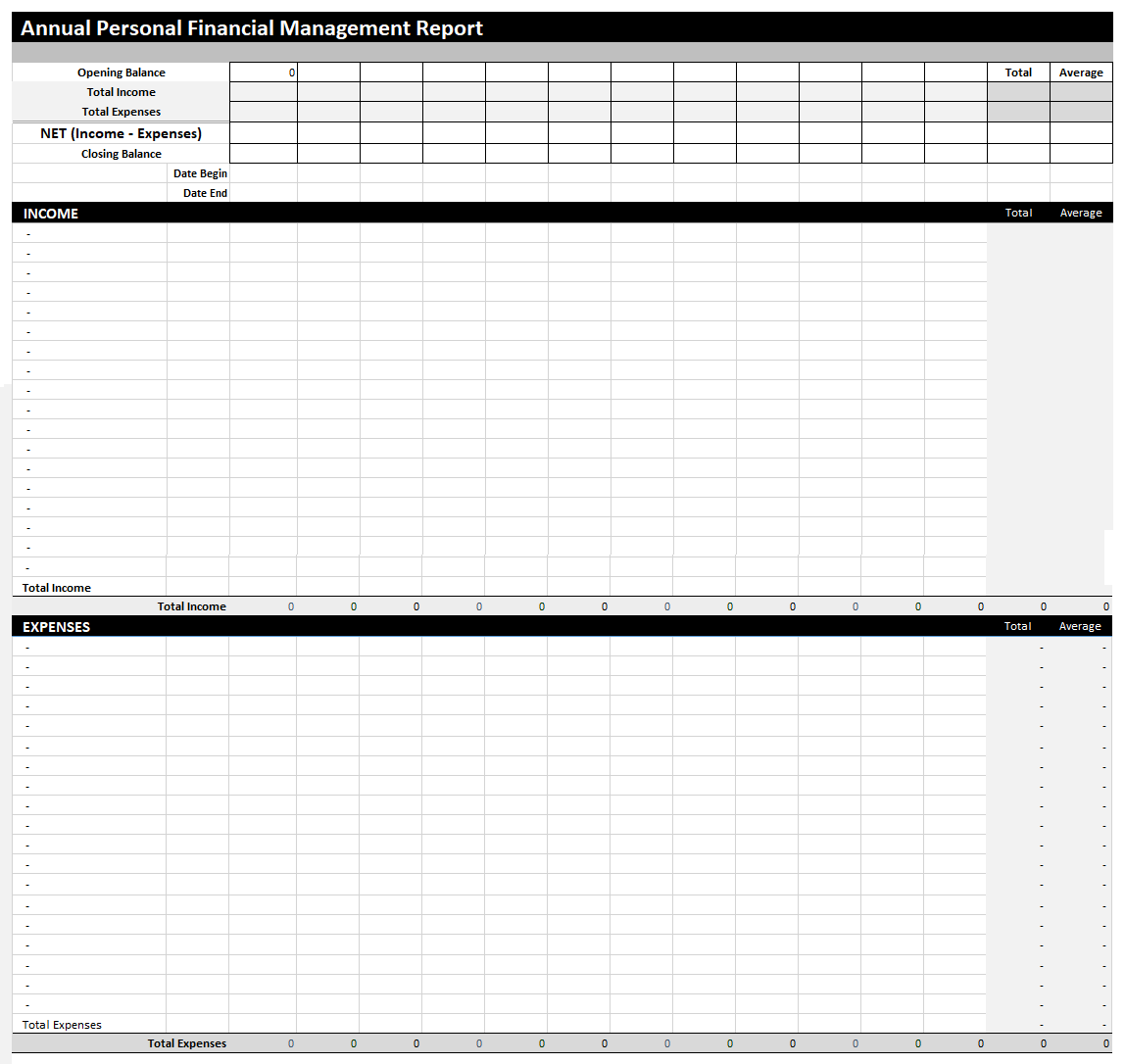

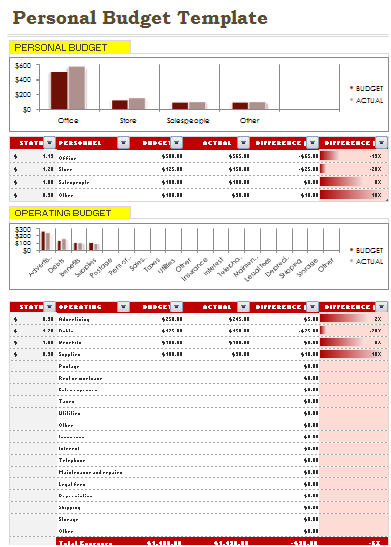

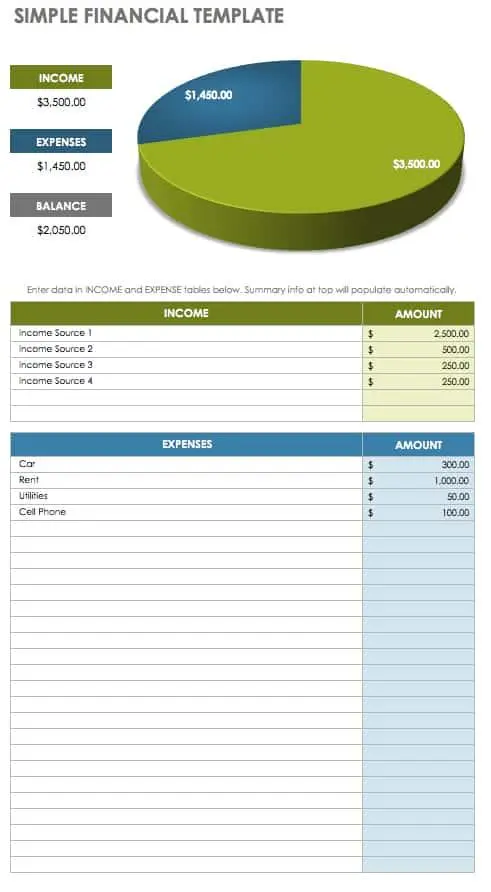

A personal financial management template entails managing the finances of someone or yourself and having them all in one place to have a better understanding of the cash flow. It can be done manually on a document or digitally on computer software or a template. A personal financial management template gives you a detailed financial summary of your assets and daily transactions. It gives a better understanding of the direction in which the cash is flowing so that you can plan your future finance-related strategies accordingly. Having a look out for your finances gives a sense of security and mental peace in general and saves you from stress through economically critical times. Additionally, it improves the standard of living for the person having their finances managed through personal financial management. Having all of your transactions accompanied in a single place to review them whenever needed gives you a sense of control over your finances.

Importance of Personal Financial Management

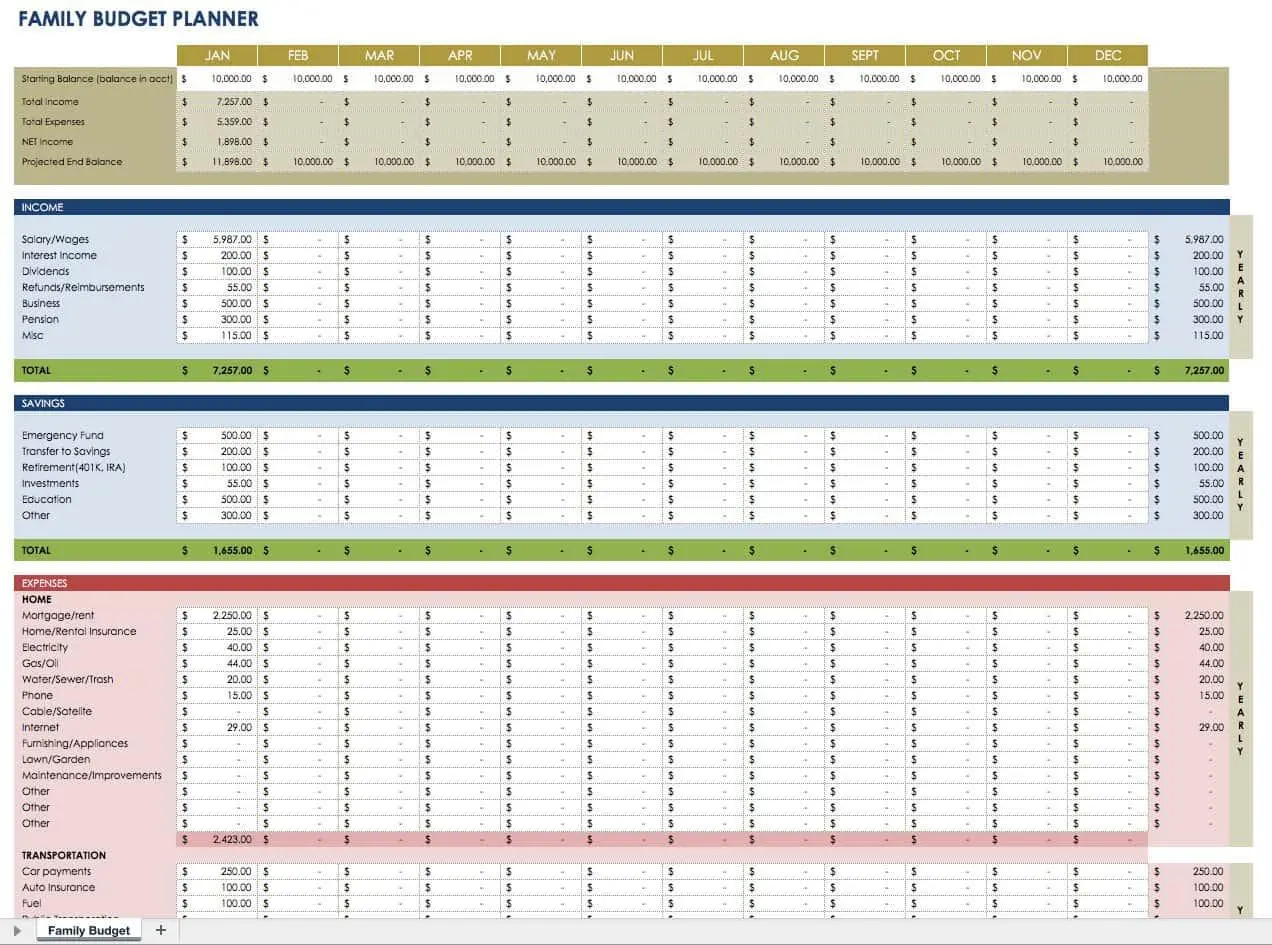

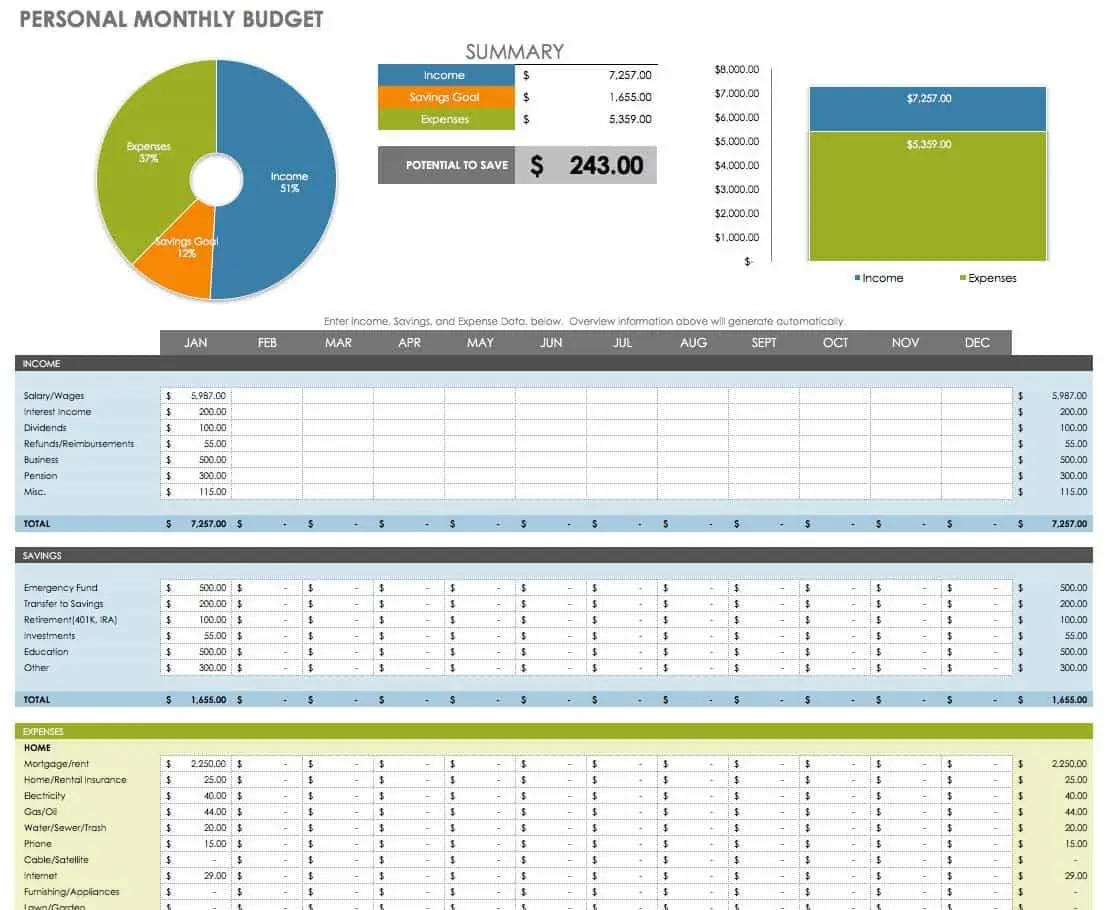

Attaining financial stability is essential in times like these when there is no guarantee for anybody to run out of business any day. It all comes down to keenly keeping a check of your income, budget, expenses and savings. Personal financial management allows you to do all of that on the go with the ease of merely entering some figures into a given template. The modern software for personal financial management allows an Artificial Intelligence feature to further strategically manage the finances by giving ideas and pointers to further administer them in an even more organized manner.

Strategies For Personal Financial Management

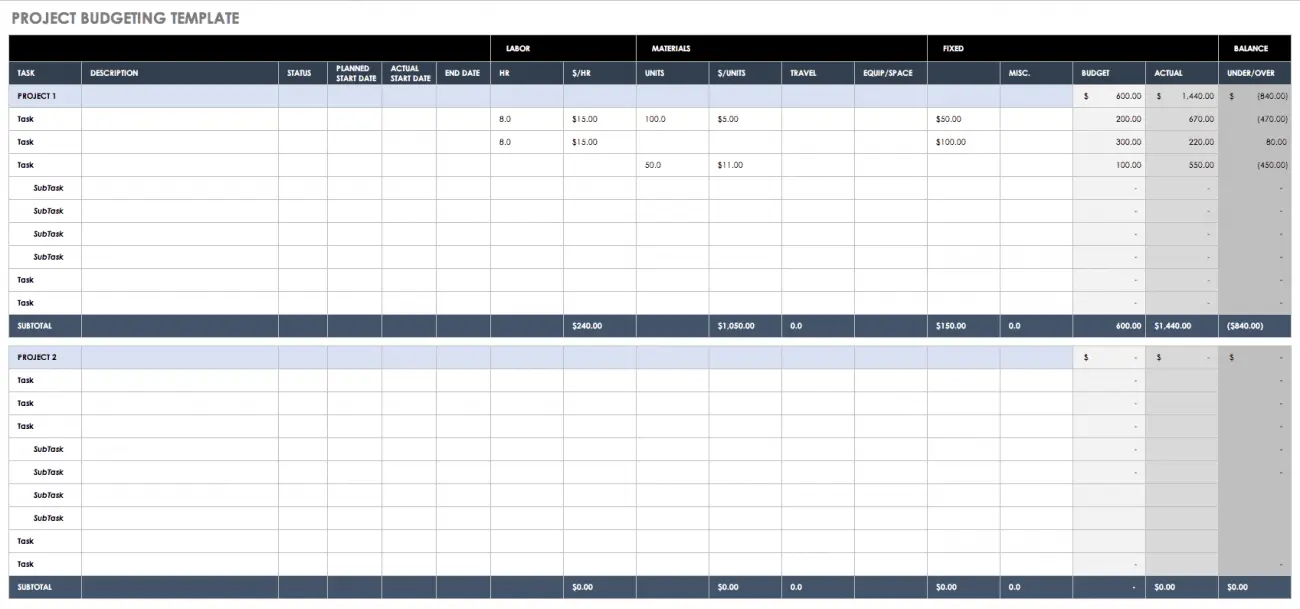

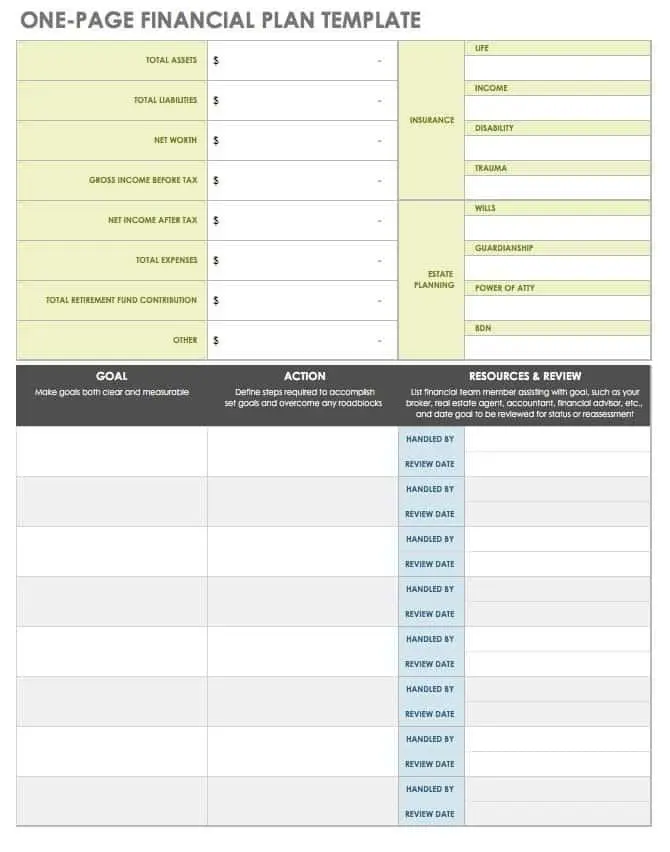

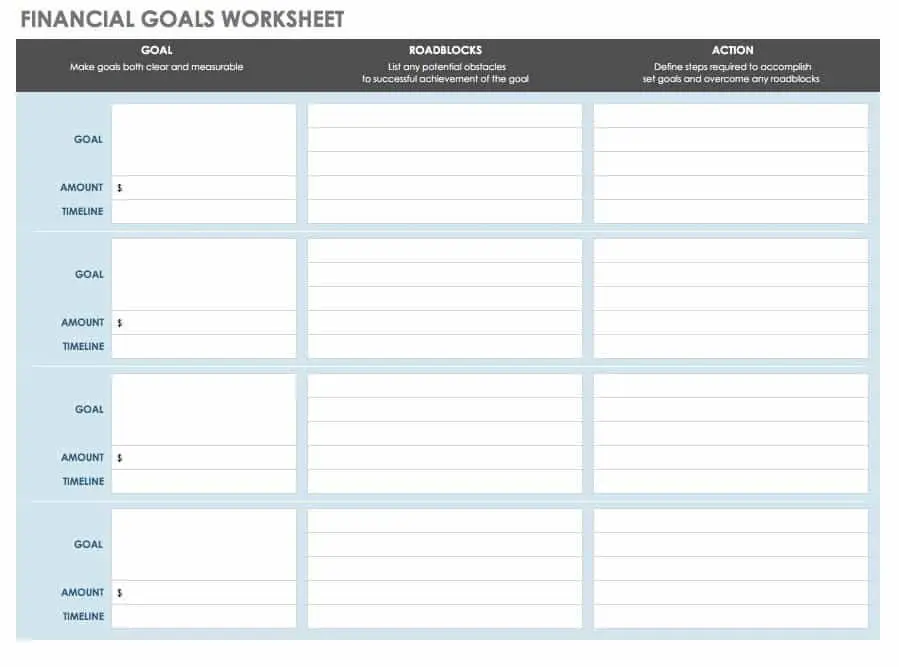

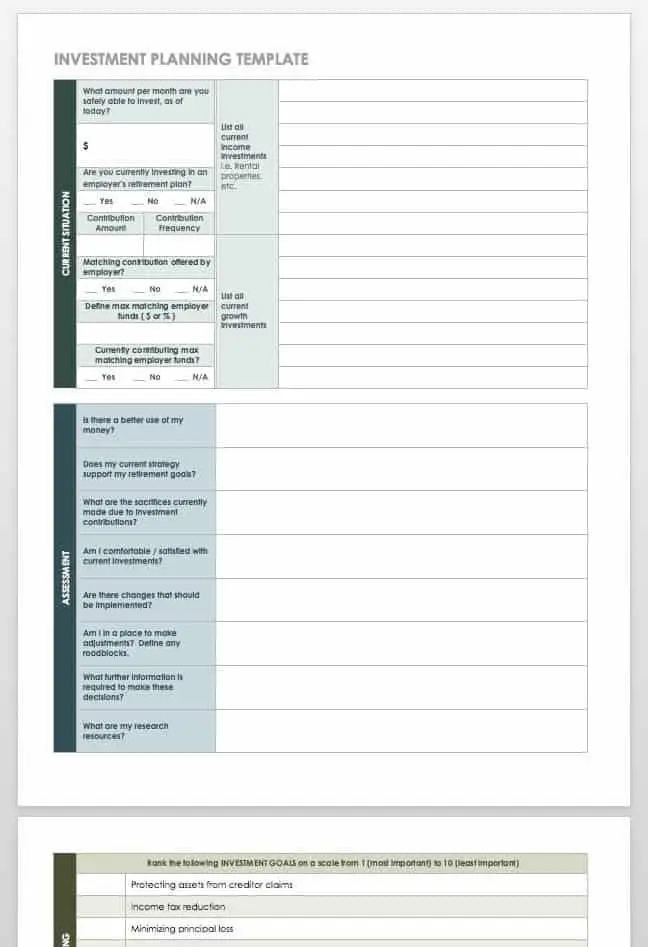

There are a number of various workable strategies on how to manage finances with little or no risk of loss. Everybody can choose and plan as per their requirements and whatever suits them best. Preferable, it is advised that one should hire a professional for personal financial management if the assets and investments are dispersed into various places. Lastly, it allows you to develop a habit of budgeting in advance and setting bigger goals to attain financial growth and stability. Most importantly, the goals that you set for yourself to grow financially must be measurable, realistic and attainable. There must also be a timeline decided for each and every goal in order to keep motivation alive.

Benefits of Personal Financial Management

There are innumerable benefits of having a personal financial management plan to cater to your finances. Most of all, it gives an overview of the cash flow and lets you manage and plan ahead of time to make the most of your current finances. Having a clear knowledge of the incoming cash would allow you to have a better picture of how and where it should be spent to keep the flow running and make it efficient. It allows the capital to grow and run over time. Likewise, assets become more valuable with time and you can acquire more over time.

A personal financial management template allows you to set aside a part of your assets as savings to be used in times of need. It helps individuals and businesses evaluate risks and plan everything strategically ahead of time. Moreover, personal financial management also allows you to keep track of the debts and payments due so that you can keep aside enough budget to deal with them. Having your finances in check provides you with hidden opportunities to minimize expenditure and increase revenue and have more in savings.