A personal budget template expresses the brief points of interest for all the individual costs that an individual or a family makes in a predefined time span. A personal budget conceals every single one of the costs and gives an aggregate total of the measure of cash spent. Personal budget formats are generally created for month to month costs to keep a record and to discover approaches to spare cash in the future. These formats help you keep a record of your expenses and keep you from spending them, essentially. Now and then, banks request personal budget formats to assess the costs of a person while issuing a charge card or a credit card. Moreover, a summary of the personal budget can likewise be displayed in court to determine some sort of lawful issues.

Significance of Personal Budget

A personal budget is said to document the details of the proposed budget beforehand. Just like companies and organizations prefer to estimate their yearly budget or a proposed budget for the projects they take, similarly, maintaining a draft of the personal budget helps in financial growth. The personal budget template includes a detailed list of categories and sections that must be kept in mind before calculating the net budget. As they say that planning for the future is the key to success, therefore people hire specialists or better known as financial experts who are well aware of every expense that is likely to be made in the future.

Components of a Personal Budget

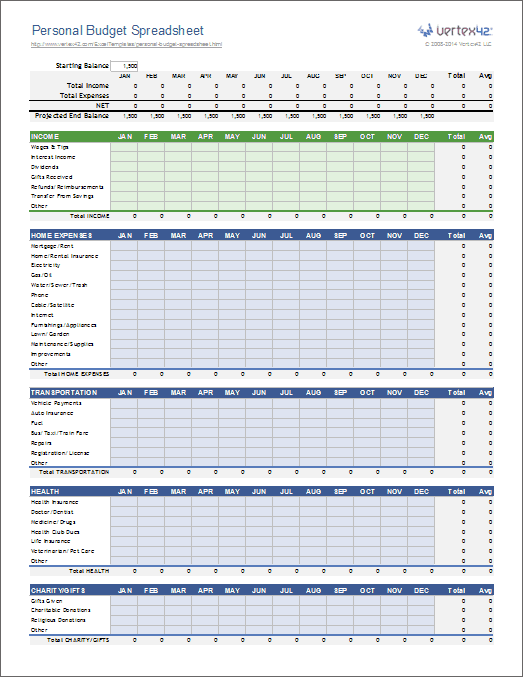

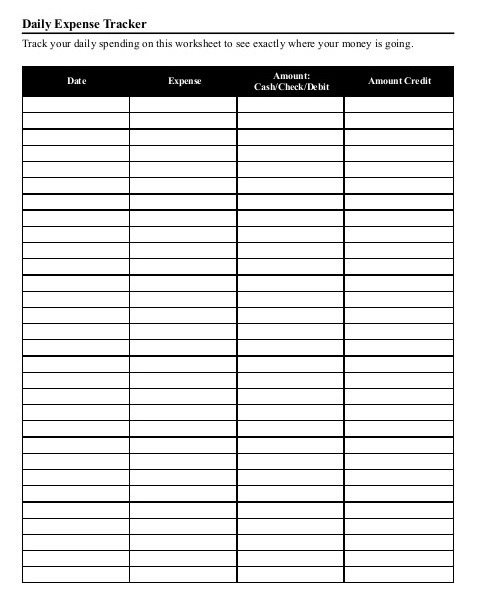

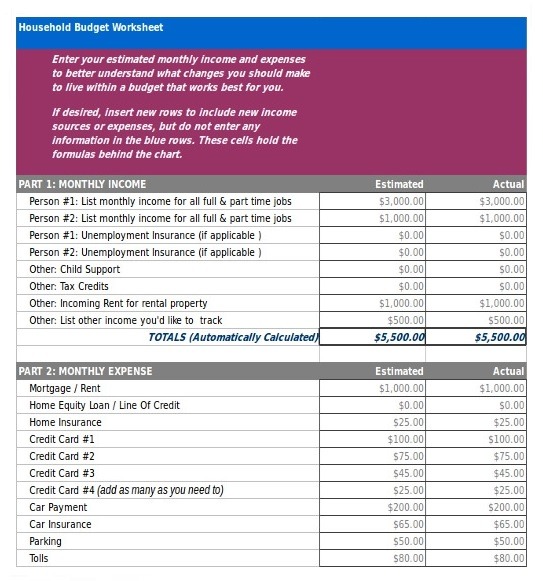

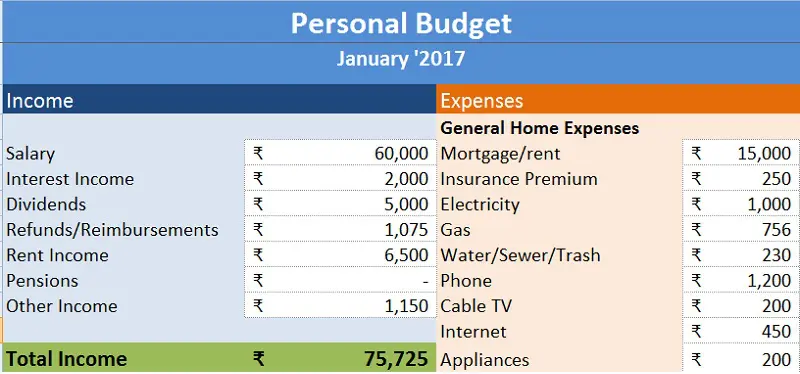

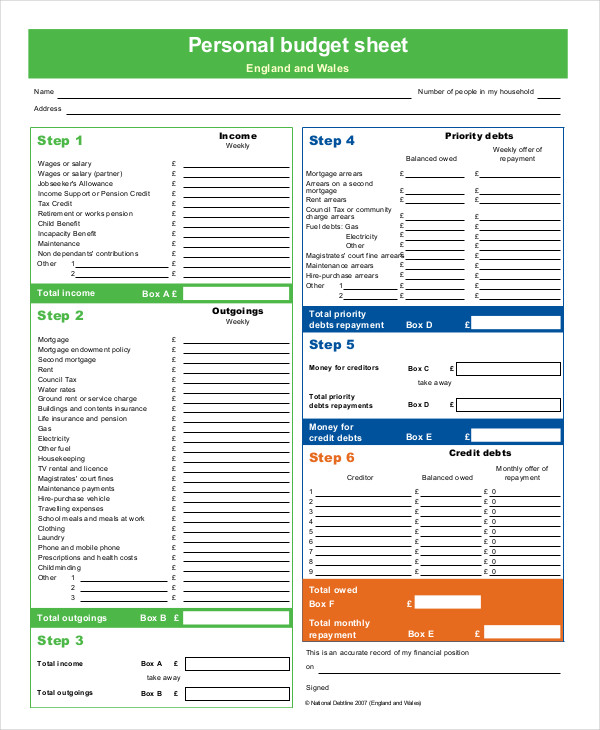

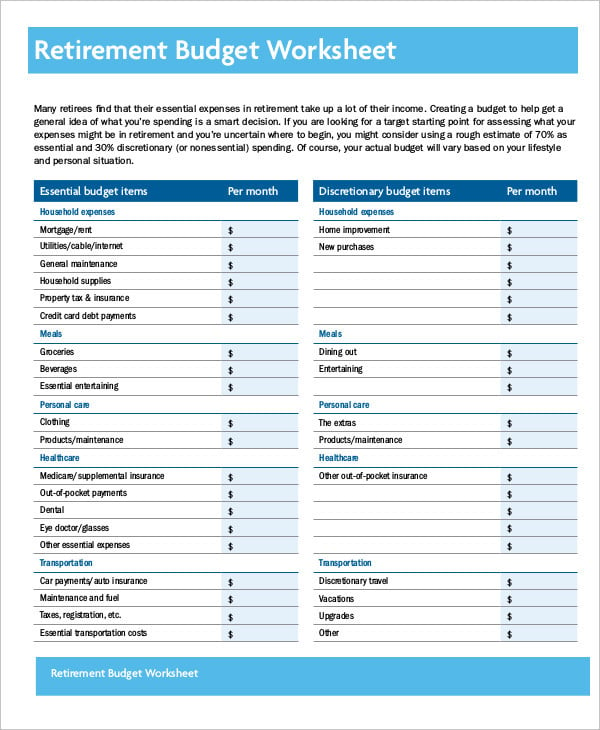

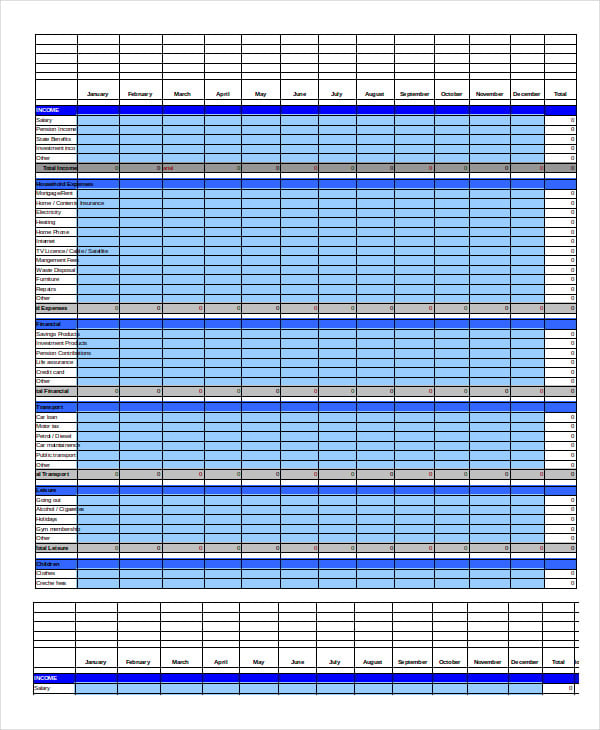

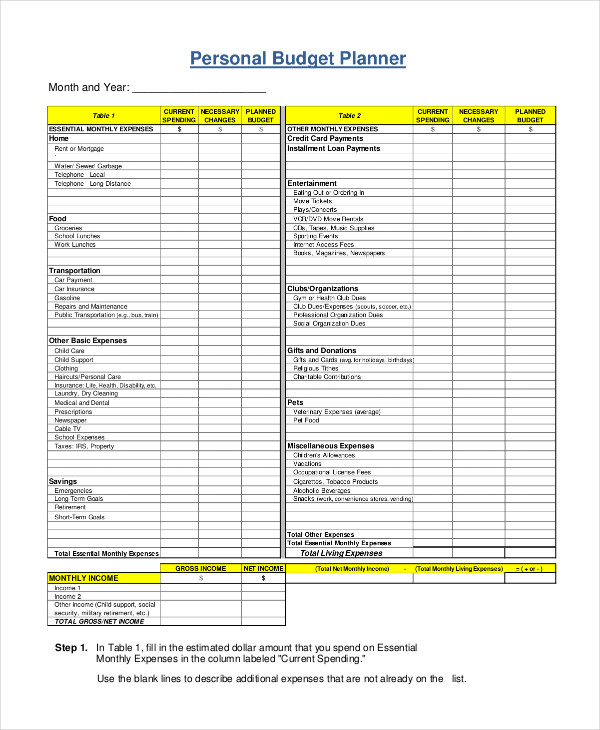

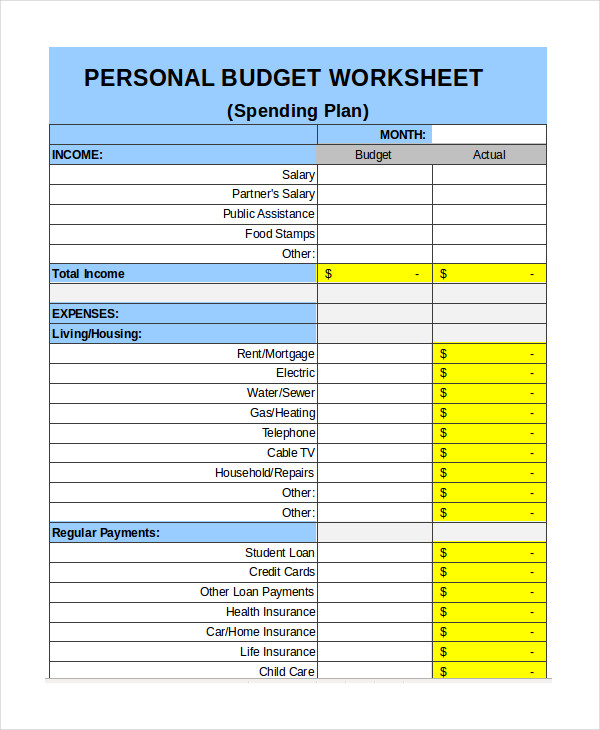

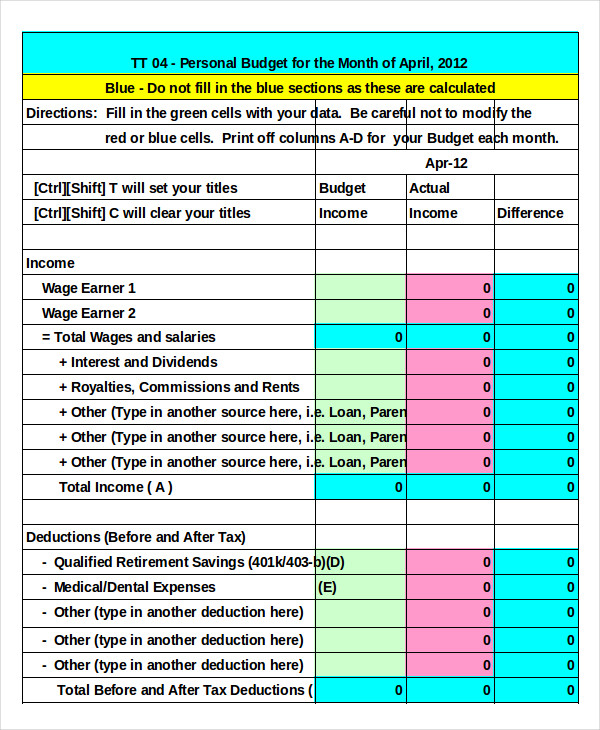

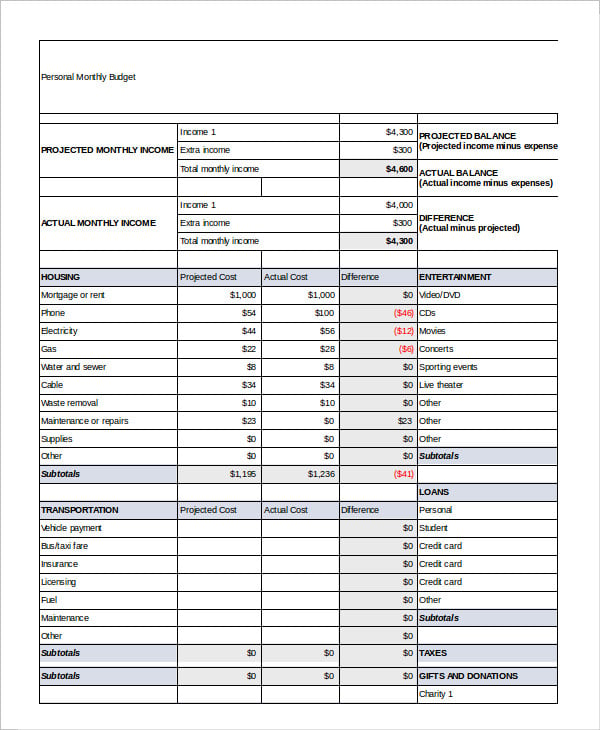

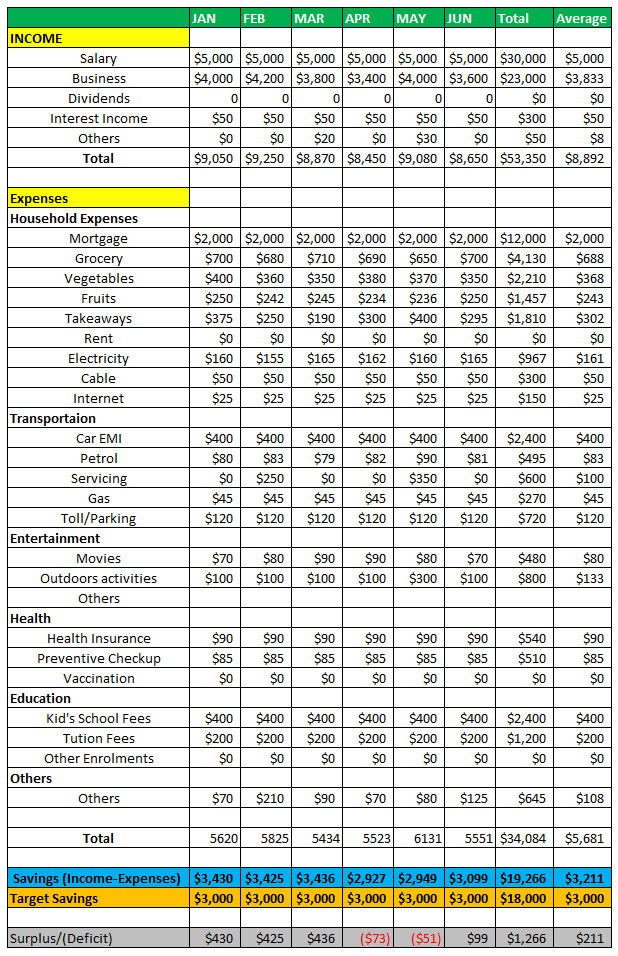

A personal budget consolidates the rundown of the considerable number of types of costs made in that month alongside the aggregate sum spent on the individual causes. It is favored that you add dates or timings to the personal budget format. Moreover, this budget format can be made into a table or even a rundown. The name of the individual engaged in the consumption is additionally added to the personal budget format. The sum of all the personal expenses is totaled toward the end of the report. On the off chance that the personal budget is being made for an association or a company, the name of the organization is likewise mentioned in the personal budget.

Details of Personal Budget

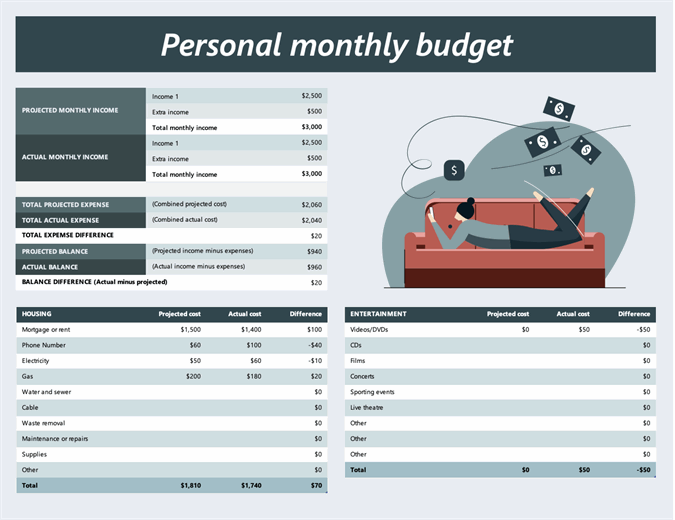

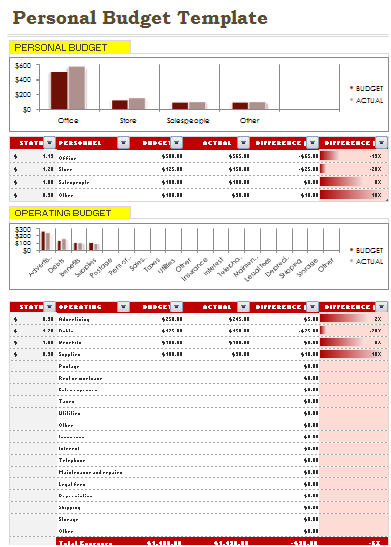

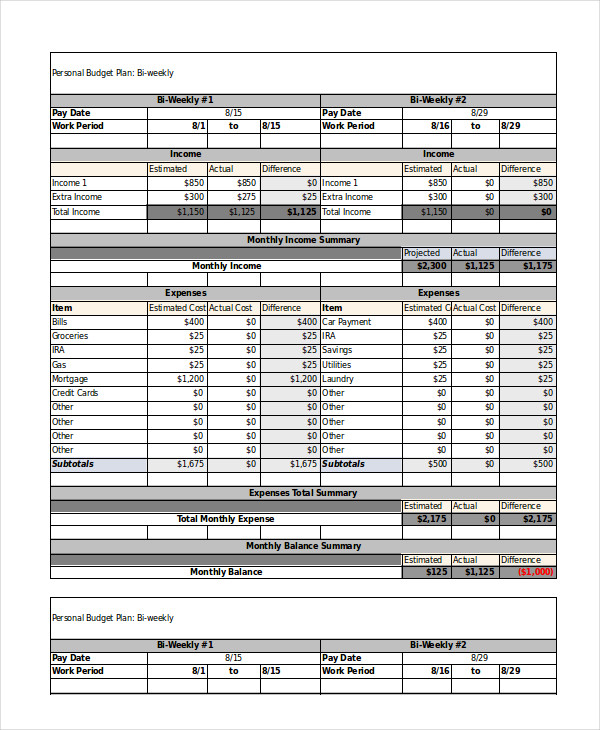

It is prescribed that the time period for which the costs are being ascertained ought to be included in the format. An area for extra remarks is likewise added to the personal budget for expressing the details of any miscellaneous expenses. Following these, a detailed list of the possible expenses is included in the personal budget. This format also incorporates the estimated amount of cost or tax applied on a particular expense, equipment or a service being used for personal use, business or the company. The personal budget sample also contains another column for the actual budget being spent on those particular items or services.

Overview of Personal Budget

A budget planner format is a record that expresses the points of interest in the proposed spending plan. As it’s been said that planning for what’s to come is the way to achievement, consequently, individuals with their assets invested in multiple places employ professionals or otherwise called monetary specialists to make budget planners for them. The personal budget gives an overview regarding what the benefits are along with expected income that can be obtained in the following budgetary year. It incorporates a rundown of classifications and segments that must be remembered before computing the net spending plan.

Benefits of a Personal Budget

A personal budget gives you an itemized monetary rundown of your resources and everyday transactions. It gives an extensive summary of the cash flow, so you can design your future financial strategies appropriately. Also, it improves the way of life for the individual having their funds overseen through close-to-home monetary administration. Having the entirety of your financial transactions combined into a solitary spot to survey them at whatever point required gives you a feeling of command over your funds.

Accomplishing monetary security is fundamental in conditions such as these, when there is no assurance for anyone to run bankrupt quickly. Everything boils down to distinctly keeping a check of your pay, financial plan, costs and investment funds. Individual monetary administration through personal budget permits you to do the entirety of that in a hurry without hardly lifting a finger or just entering a few considers along with a given layout. In particular, it gives an outline of the income and allows you to oversee and prepare in time to make full use of your present funds. A personal budget additionally permits you to save a piece of your resources as investment funds to be utilized in the midst of hardship. It helps people and organizations assess dangers and plan everything deliberately early.