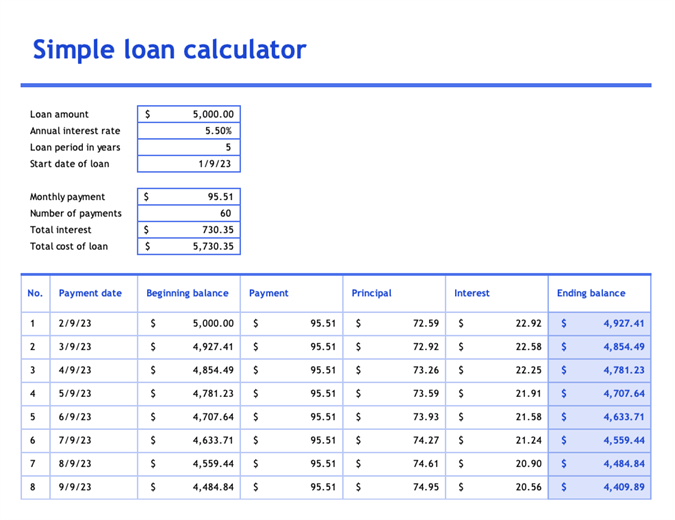

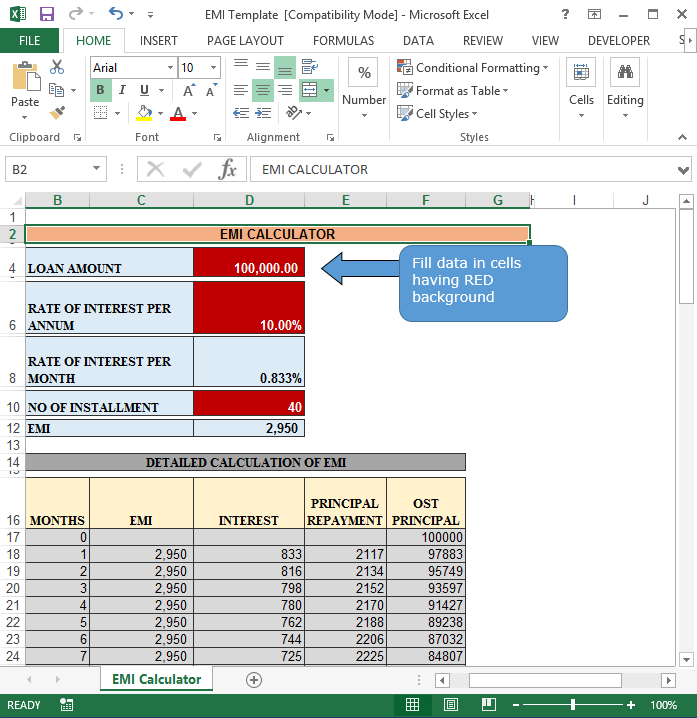

A loan calculator template is a professional document consumed for determining crucial factors of loan. It helps you to analyze repayment plan, interest cost, and amortization schedule of conventional amortized loans, deferred payment loans and bonds. This document acts as an accounting tool which is highly consumed for calculating essential components of loan. Basically, a loan is an amount received by a borrower which is obligated to pay in the future. A loan calculator is a document which allows sufficient space for calculating interest rate, insurance and other financial conditions of loan. The amount of loan is payable in installments by paying interest along with actual payment. A loan calculator plays an important role in determining monthly installments of loan, and you can evaluate your income or revenue which should be able to possibly pay monthly installment of your loan. It is a great source of analyzing loan repayment period or payable amount of your loan installment. You can adjust precise installment for your loan and can get different ideas for easily repayment of loan. Usually, this calculator consists of heading, date, time and sufficient space for calculations of amount or interest rate. If you wish to develop a well presented loan calculator, then use a brilliant template.

Benefits of Loan Calculator

There are many benefits associated with the usage of a loan calculator. You can read and understand the following benefits as a quick reference. These are given below;

1- A loan calculator prepared in MS Excel provides ease of use.

2- A calculator is required to compute results based on minimum data. There is no need to gather huge amount of data for this purpose.

3- It is used to provide complete information based on data inserted.

4- A simple user of Microsoft can use these templates with much ease and fun.

5- Loan calculator templates enable the process of calculation prompt, accurate as well as transparent.

6- It has used to understand how much amount can be paid as advance to avoid specific interest expense either monthly or annually.

7- A loan calculator assists users to understand how much amount they will pay till the end of loan term. They also can evaluate what term or number of years are suitable against principal amount.