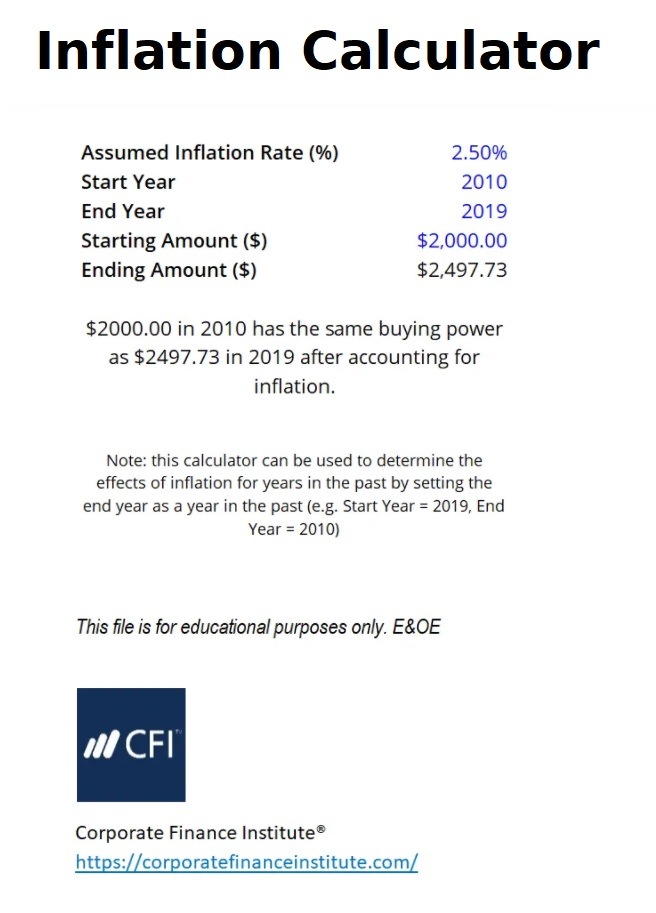

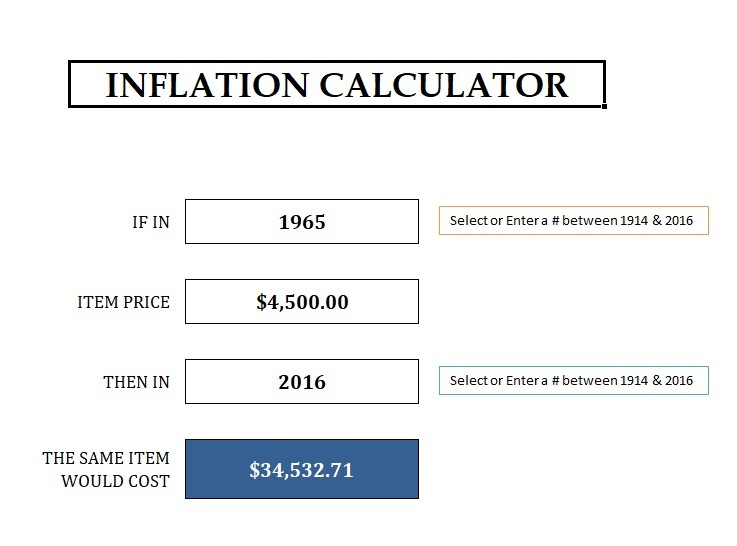

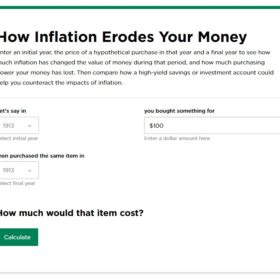

The inflation calculator template is a customized calculator that examines the increment in the prices of labor and products across an economy. Inflation is fundamentally portrayed as consistently rising prices, or the ceaseless fall in worth of the dollar. At the point when prices expand, you need more cash to purchase exactly the same things. Something contrary to inflation is deflation, when prices become lower across the scope of labor and products. Inflation is a significant idea for financial backers to comprehend in light of the fact that it causes a decrease in your profits on your ventures. The Inflation calculator, to put it plainly, computes future qualities dependent on a supposition of the yearly inflation rate. Preferably, an ideal degree of inflation is needed to increase spending partly as opposed to saving, consequently sustaining financial development. People with resources that are priced in cash similar to property or loaded products may jump at the chance to consider a small amount of inflation to be what raises the price of their resources, which they can sell at a higher rate.

Employments of an inflation adding Machine:

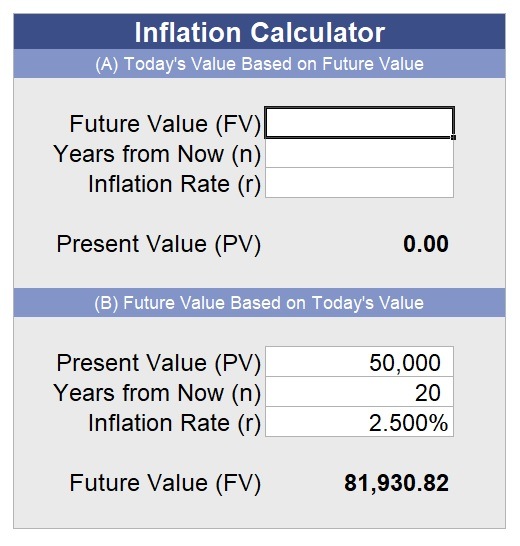

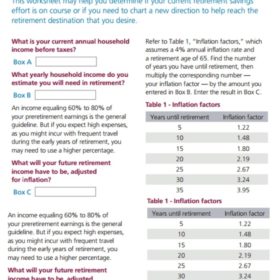

• This is particularly useful for retirement plans, where you may have to settle on how much cash you can live on after retirement.

• The inflation calculator permits you to make expectations about the future dependent on any inflation rate that you determine.

Principle behind an inflation calculator:

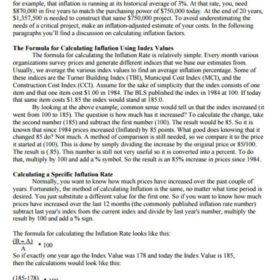

We don’t regularly keep large quantities of cash in our houses. Usually we like to keep our reserve funds in ledgers or contribute them. These frequently have a given loan fee, which makes our investment funds increase from an underlying worth to a future worth. At the point when you get cash, however, there will be inflation on the net sum, contingent upon the genuine loan fee. On the off chance that the inflation rate is higher than the loan fee, the cash you owe is worth less in the long-term. To quantify the inflation rate, you can’t simply take a solitary decent and measure how its price changes.

How the Inflation calculator works?

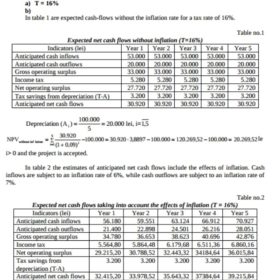

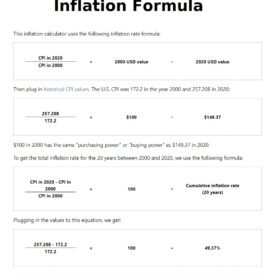

Since inflation can be characterized as supporting an ascent in the overall price level and not the price level of just a couple of products. However, ascertaining the right pace of inflation in an economy includes painstakingly gathered informational indexes and complex measurable procedures. Most online inflation adding machines depend on the recorded quality of the consumer cost index (CCI). These are valuable for recorded examinations, and you can likewise take a gander at chronicled inflation rates to assist you with choosing what rate to expect for what is to come.

Why need to compute the inflation rate?

On the off chance that your pay remains something similar while prices go up, you’ll feel the impact of inflation. Your cash will not stretch as far, and you’ll need to roll out certain improvements to your spending plan. In principle, compensation and wages should ascend to stay aware of inflation, so laborers can keep up their way of life. Government managed retirement benefits, as well, are liable to Cost of Living Adjustments that consider rising prices. In the event that your pay increases at a similar rate as the inflation rate, your buying power isn’t decreased. It doesn’t develop or contract. On the off chance that your salary increases at a rate more noteworthy than the inflation rate, you’ll have the option to manage the cost of more labor and products. This is the situation a large portion of us need. It causes us to feel better to see our buying power developing after some time. It is obvious that if your pay recoils or vanishes, you may be in a difficult situation. Others who feel the adverse consequences of inflation are those on a fixed pay, or the individuals who hold fixed-pay ventures while inflation negatively affects their buying power.

Benefits of Inflation Calculator

An inflation calculator template is a very amazing and powerful tool for many reasons. There are countless benefits attached with the proper use of an inflation calculator. Some of the most common benefits are given below for quick review;

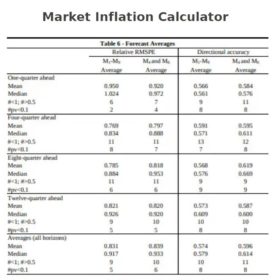

• This format is used to obtain vital information regarding various factors like: Inflation rate, Trends and Consumer Price Index (CPI).

• An inflation calculator serves as an important tool to accurately measure future investment prices and rates.

• This calculator also depicts inflationary trends which can disturb the purchasing ability of a common customer.

• It reflects future prices of commodities which a customer can buy now but not in the future. In other words, it predicts future prices of commodities based on speculative data.

• Employees can use this calculator to determine the future value of their investment, or can determine the future value of their retiring funds.