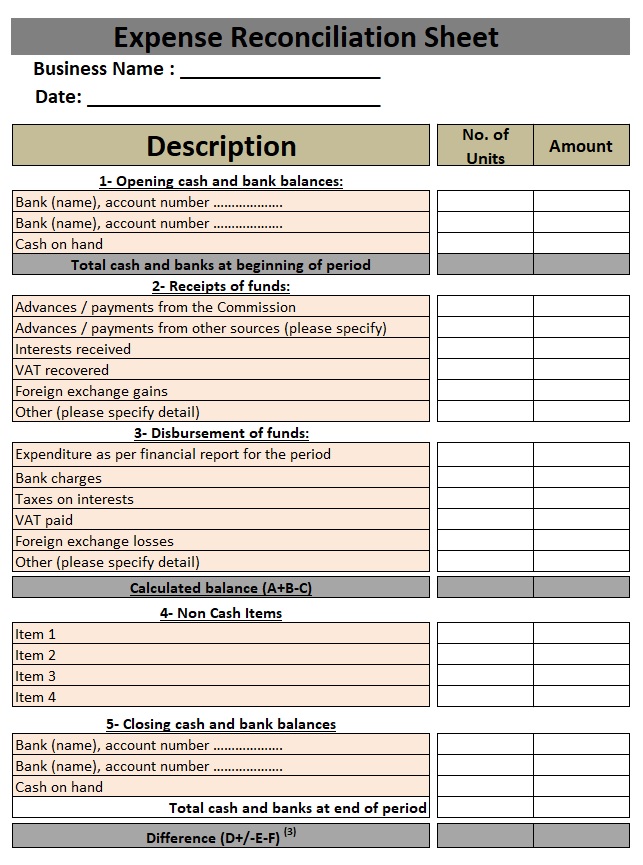

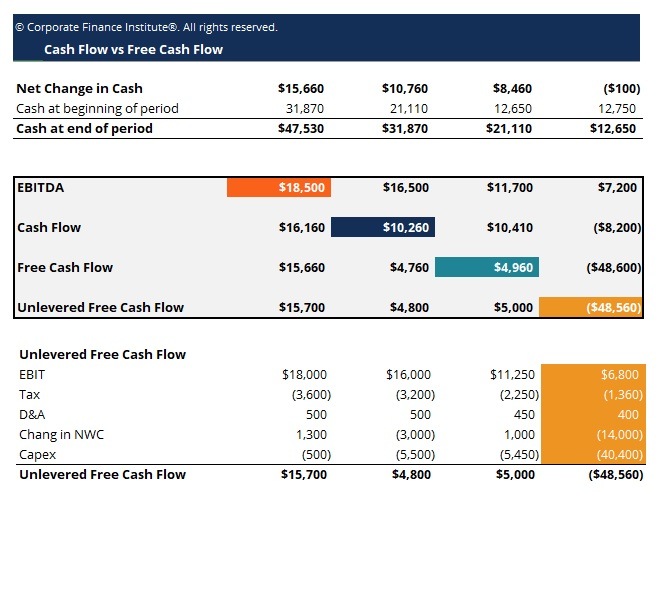

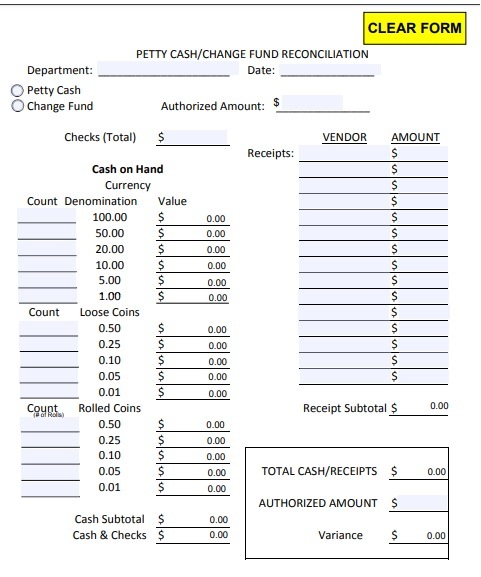

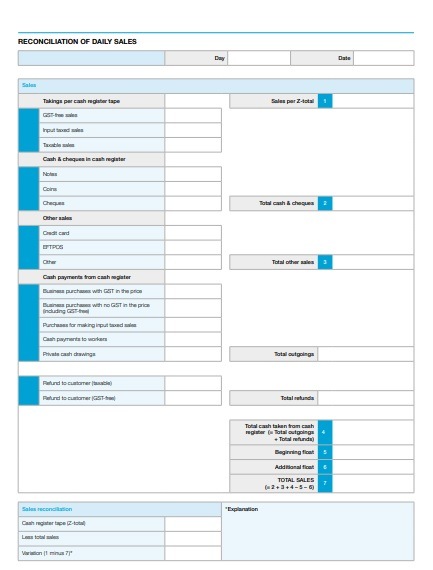

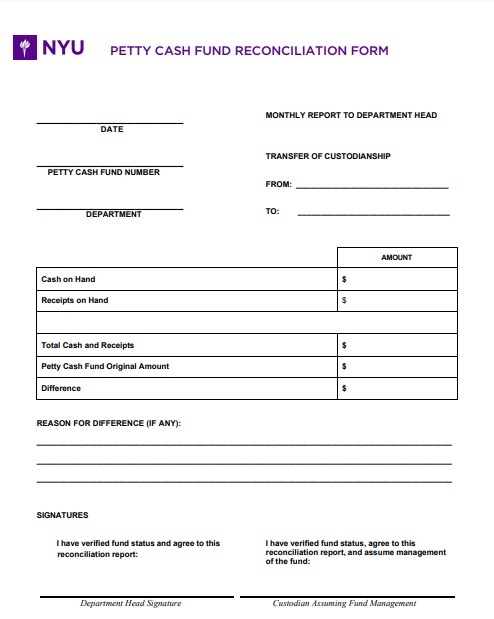

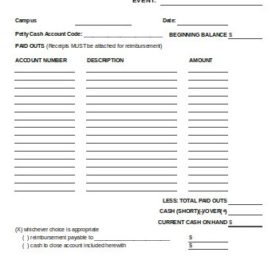

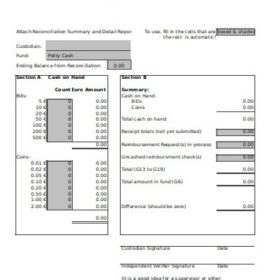

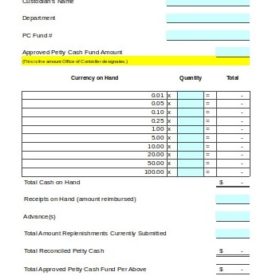

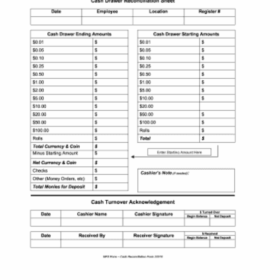

The cash reconciliation sheet template is a financial document which is conducted for the verification of the amount of cash which is added or subtracted through the transaction. It is a process through which you can easily identify all the mistakes occurring in transactions or on records. This document plays an important role in controlling business and provides a summary of cash which goes out and comes into a business through a transaction. You can easily identify all cash differences which are essential to eliminate. It also works similar to the evidence and gives detail which is necessary to determine errors that occur in cash transactions. A cash reconciliation is the best way to find out all the mistakes and errors that occur due to an unfocused mind. But after the process of cash reconciliation, it is difficult to find a new error because this process requires sharpness of the brain. You can easily evaluate accurate figures and amounts through a cash reconciliation worksheet. It is the best way to find out errors and disputes which are neglected when putting data in the cash register.

Tips for Cash Reconciliation:

A perfect way to conduct your own cash reconciliation sheet requires professional skills and knowledge. Without understanding and professional knowledge, it would be hard for anyone to prepare cash reconciliation accurately. However, underneath are a few tips which you can consider while preparing for cash reconciliation on your own. These are given below:

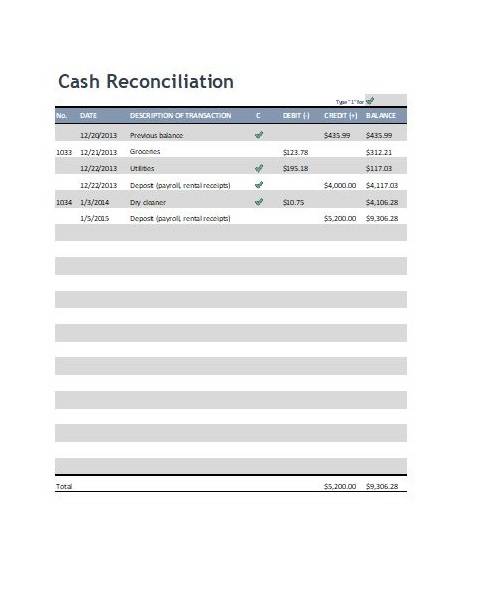

1- Checking Balances: The first step toward going for reconciliation is to confirm the balances of both accounts. If there is any gap between both balances, then it means you need to have a reconciliation sheet.

2- Spot Differences: Once you have both ledgers, and you know the differences, now it is time to find out the differences. The best way to point out, you will need to check each and every transaction during that period. You need to spot the differences in transactions either in debit balance or credit balance.

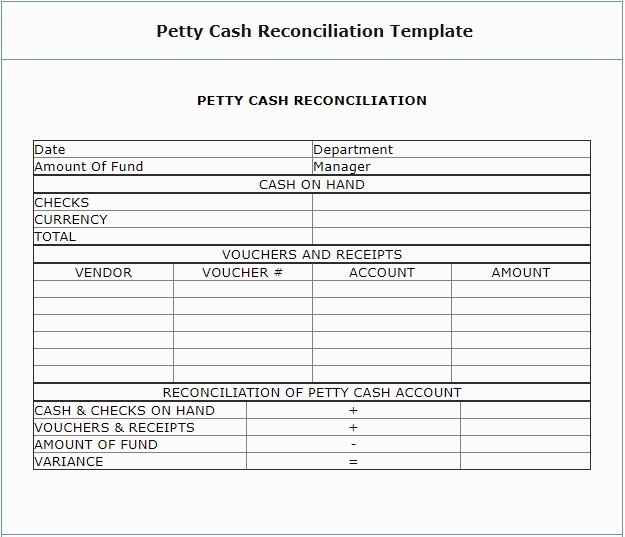

3- Cash Register: You can write down all the differences which you highlighted during your inspection in a cash register. This can help you to understand total transactions where there is a difference either through typing mistakes or due to human error. You can list down all such entries and can point out the total amount of difference.

4- Reconciliation Sheet: You have all the entries in which you know the differences, and now you can prepare your reconciliation sheet. You have to rectify all transactions which are causing trouble. For that purpose, you can hire the services of experts who can balance your accounting system by posting right rectified double entries. This way, you can make the necessary adjustments to both ledgers and the new balance will be the same on both ledgers.