In business world, A break-even analysis template is a tool which is actually a point at reaching company breaks even, seemingly it will help the business to prepare for expansion. Thus, a break-even analysis is used to calculate what is known as a margin of safety, where the earned profit is equal to investment and the business can prove very athletically. It is helpful for deciding whether to make a purchase before reaching on the level of break-even or not. Here people can use variables to compute a break-even analysis. In addition, the actual amount that revenues exceed the break-even is noted as a point of break-even, although the amount that revenues can fall will stay above the break-even point.

Assumption and Limitation of Break Even Analysis

Break even analysis has great importance and very useful for not only professionals but also for young individuals. Every passing day, this tool is being accepted by people around the global as a great help to improve their businesses. Nevertheless, like any other analysis tool, it also has some limitation and assumptions. Here underneath we shall try to elaborate each and every point clearly, for your ease. These points are given below;

Assumption of Break Even Analysis

Following points are some of common assumption of this tool and these are given below;

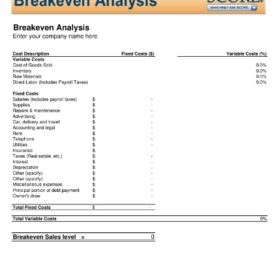

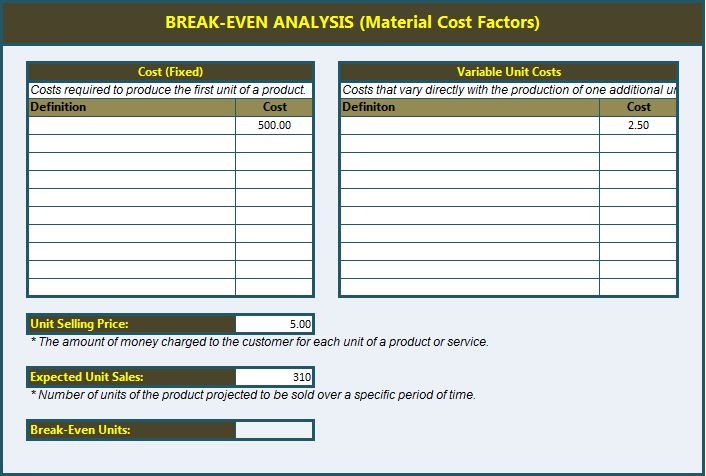

1- Types of Costs: There are two types of cost of any project or business; fixed cost and variable cost. A fixed cost is remained fixed throughout the life of project. Whereas, variable cost remains variable depending on different elements.

2- Earnings: Earnings are the source from which investment cost is recovered or balanced. It will continue to flow until business activities are ceased. Its trend can be seen in upwards and downwards throughout the life of business.

3- Sales Price: A sales price is the cost which consist of total cost plus profit. A sales price per unit can be obtained from books of account to determined the amount of earnings.

4- Volume Or Number of Units Sold: Total amount which can be recovered in shape of earnings will remain unchanged until total earnings crossed initial investment.

5- Extra Ordinary Events: No special event can change or alter fixed and variable cost expect extraordinary events, which must be expressed in written. Sales price as per calculated should remain unchanged.

6- Other Factors Remain Same: All other factors which are considered in analysis will remain the same. These are technology, equipment, production methods and working efficiency.

7- Inventory: There are no opening balance and ending balance of inventory. Whereas, inventory quantity will also remain the same and unchanged.

You can check our Problem Analysis Example.

Limitations of Break Even Analysis

1- Output Cost: Based on analysis, inventory will remain the same but as production increases, output cost will also increase which is ignored in this method.

2- Change in Cost Amount: Fixed cost and production cost remain the same whereas, it is not possible due to production errors and breaks. Fixed cost of per unit can remain same but variable cost per unit can change with the passage of time. This assumption is not valid in this method.

3- Output Levels: Sales cost and variable cost both may variate as production increases or decreases and it is not assumed properly.

4- inflation: Inflation rate is not considered in calculation and that make its assumption non-workable. Inflation rate is part of external factors which are considered unchanged.

5- Production Methods: Change in technology can provide more economical methods of production which is ignored in this tool. Production cost vary from each production level and this is also ignored while computing break even analysis.

Importance of Break Even Analysis

While living in the modern world of business, if you’re running a company or brand than obviously you’ll always find a familiar tool for tracking the cash flow of your company professionally. Well here in this article we’ll talk about break-even analysis, basically a break-even analysis is a scientific term which pretty much useful for calculating the cash flow. However, this analysis will conduct as a fairly simple calculation where you can determine a solid point at which your company receives revenue equals the costs those thoroughly associated with the receiving revenues. Moreover, as we can assume that there is always a point reaching on it company becomes a profitable enterprise.