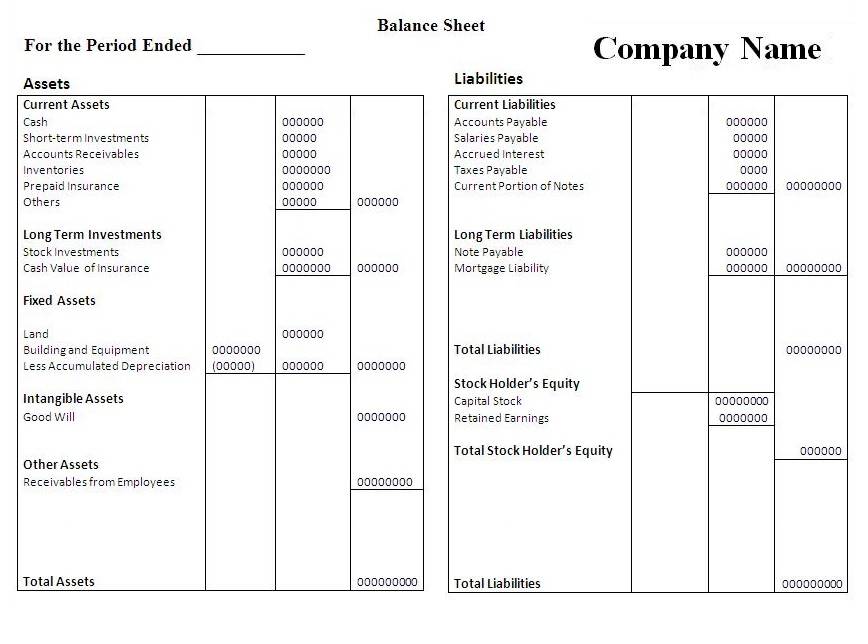

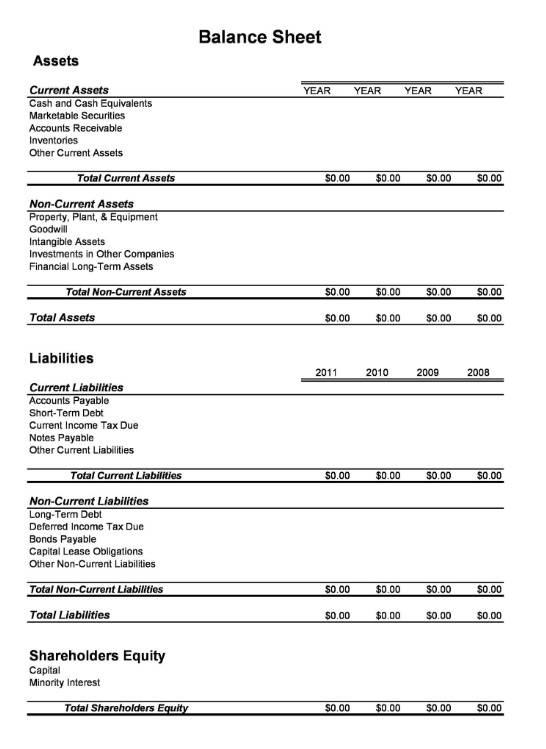

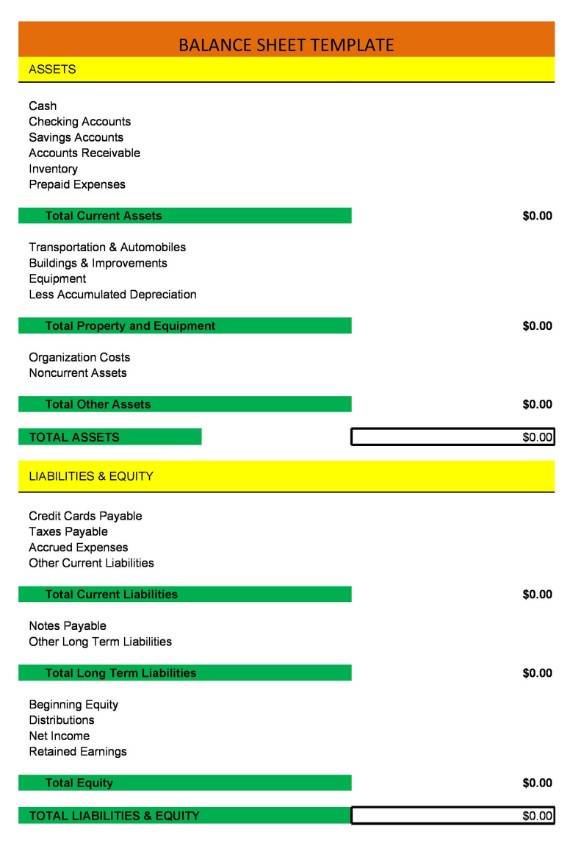

A balance sheet template is a unique document specially created for the purpose of analyzing the current position of any business, company or organization. It describes in detail all categories of a balance sheet, like assets and liabilities. The asset side of a balance sheet consists of current and fixed assets. It further explains fixed assets, which include details about buildings, machinery, equipment, and land. This document provides all information about cash flows during business transactions and refers to it as a statement of financial position. A balance sheet offers net values and a snapshot of the company’s account at the time of evaluation. Moreover, it gives ideas to the owners by describing the financial position and capability of their company. Usually, a balance sheet plays an important role in business and is considered as a key element for obtaining knowledge about the financial condition of a business. Preparing a balance is the best way to track useful details. If you are finding ways of saving time, then try to download our offered balance sheet formats.

Importance of Balance Sheet:

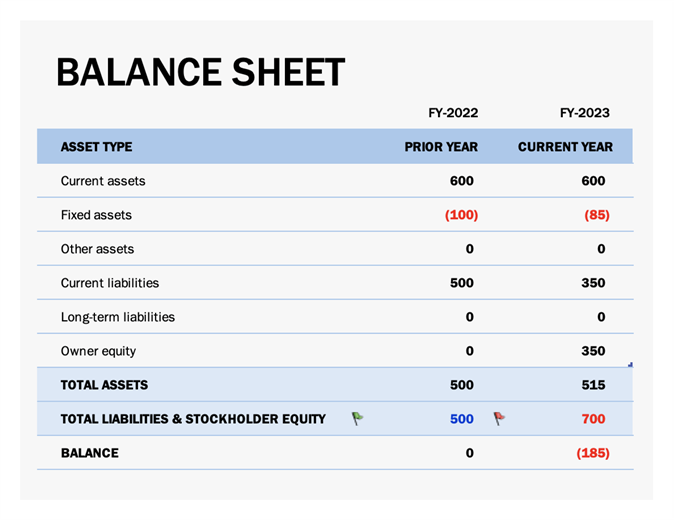

The balance sheet template is a financial format which can explain to you in detail the picture of your financial health. It makes sure your assets are sufficient against liabilities, so you can offset your current liabilities with current assets. If you wish to see your net worth in one minute, then you should probably see your balance sheet. There are other names for this format, like a financial statement, yearly financial statement or net worth statement. This is because you haven’t heard its true name, which is a balance sheet. It reflects your financial strength or weakness on a specific date, which means, at that point of time, what you hold and where you have to pay. Usually, companies prefer to prepare it on the 1st of every January each year to understand the financial standing of the company. You can compare them with previous year’s pictures and then make a prompt analysis of the financial progress. It confirms whether your organization is growing financially or not.

Benefits of Balance Sheet:

A perfectly designed or prepared balance sheet is nothing more but a handy tool. By adopting a professional format, you can get countless benefits, not only for preparing but also for other different analysis. A few advantages are given below for your ease:

1- A good professional format makes it possible to learn and understand your business’s financial strength.

2- This template is not only beneficial for you but also for management to take appropriate decisions.

3- A professional balance sheet template will make sure you get an accurate picture of your firm, because only true figures can confirm whether you are making a profit or loss.

4- Based on financial strength, either you or management can decide whether to borrow money on a short-term or long-term basis. The decision between short-term or long-term is not as simple as it looks like, because it can cost a huge interest cost to the company. Nevertheless, decisions will have to be made for financial progress.

5- As from owners, management and staff, there are other stakeholders which require information about financial growth. This format helps them to access such information in a very positive way.

6- Financial investors and shareholders are both very keen on investing. They gather information for every possible way to know and learn about their current financial position. A professional balance sheet can help you with providing accurate information for those investors. Thus enabling them to make a decision to invest in your organization.

7- There is a special note section which is given for contingent events which can cause sudden loss or profit for an organization. Based on this uncertain condition, the image of an organization has a poor reputation. Therefore, in this segment, such information can be provided to avoid certain loss of goodwill.