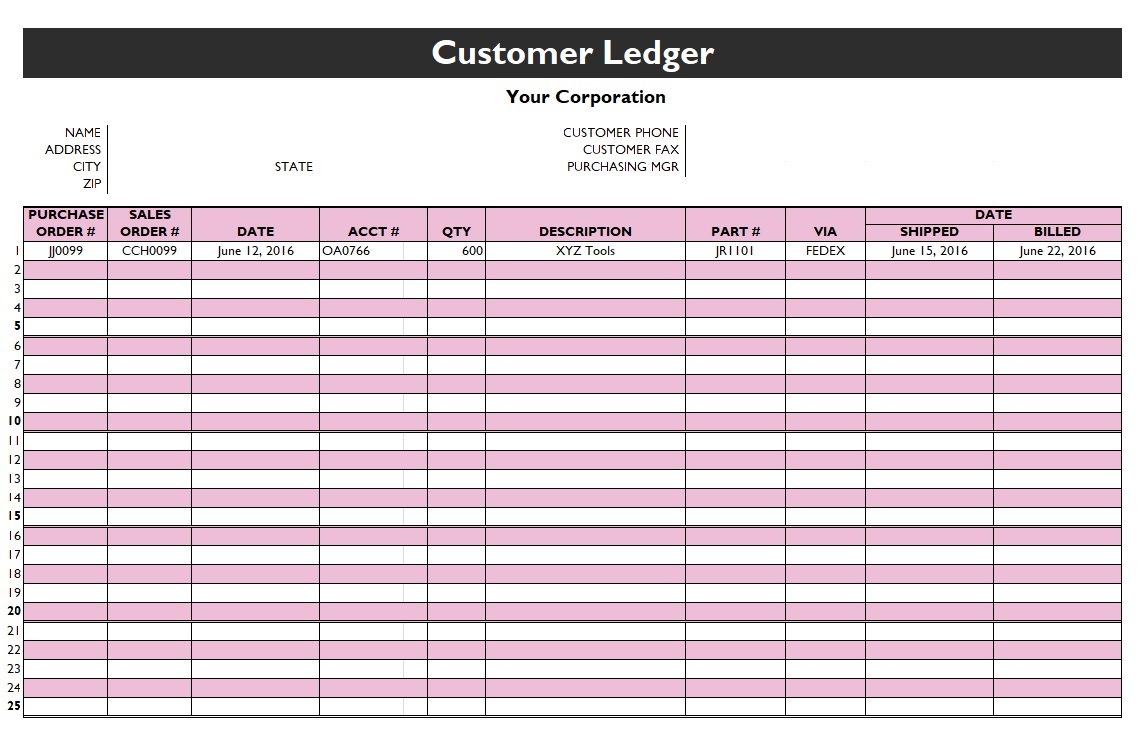

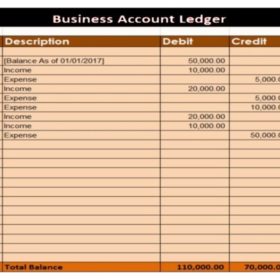

Every business requires a record-keeping of their financial matters to keep an account of the cash flow projection and the balance coming in and going out of the company. An account ledger template is the best solution for such organizations. There are a number of defined ways in which this can be done. Keeping this ledger helps accounts as one of the simpler and most common ways in which financial matters can be handled and looked out for. An account ledger categorizes the financial data of any organization into numerous sections and categories as well as sub-categories. Such categories are generally named as petty expense, cash, accrued expenses, bill receipt, income, salaries and wages and owner’s equity or shares. In short, an account ledger is used to monitor a company’s transactions ranging from its starting balance up until the ending balance. It gives a complete check of the arithmetical accuracy of financial accounts for an enterprise.

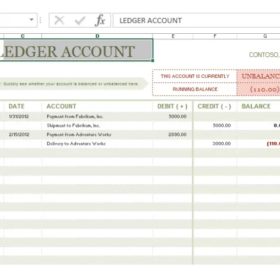

Account Ledger Accounting Software

There are numerous online pieces of software that help generate an account ledger for a company. At times, companies program their own customized software to keep the record of financial matters. As the information kept in the account ledgers is all classified therefore special measures are taken to protect the information from any outside sources. The record is initially kept as an account for a month which later on can be turned into an account for transactions done over a year. This makes it easier to fetch any specific financial record in order to deal with any sort of legal or internal matters. To this date, a few organizations still use the olden methods of keeping financial records by hand instead of using computers or pieces of software.

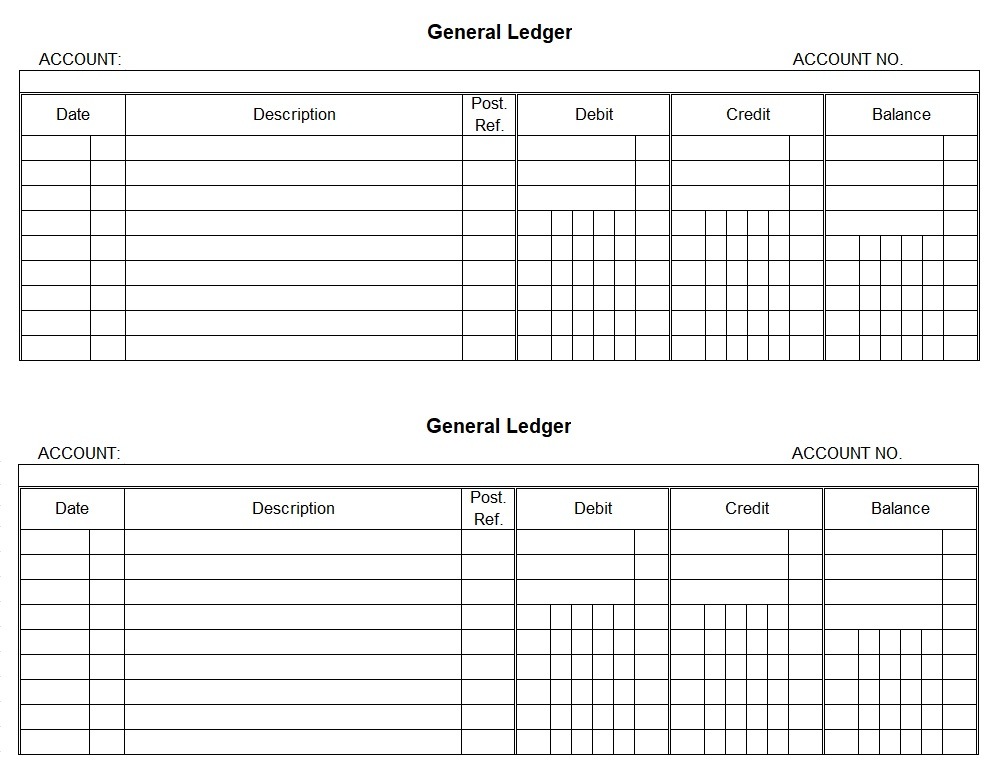

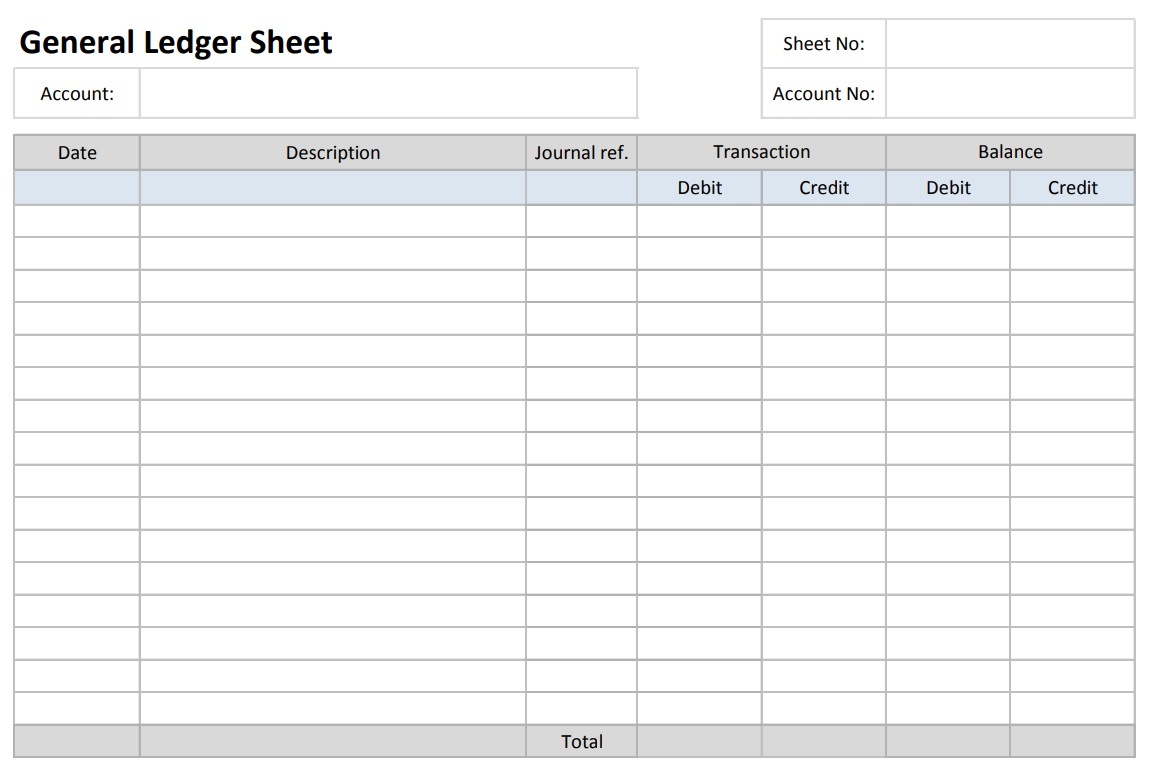

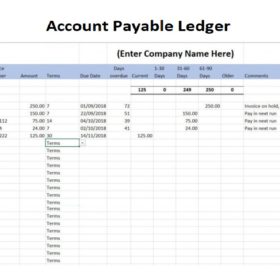

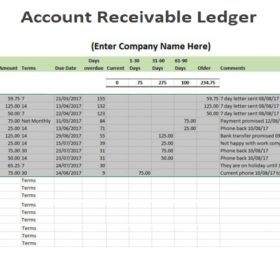

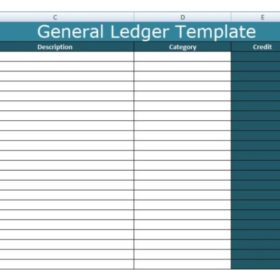

Details of Account Ledger

The data from the account ledger is then later used to formulate the company’s financial reports, financial statements, income statements and statements of cash flow. These statements are generally composed in a spreadsheet for the ease of adding and subtracting the data. It also enables to put in the formula which further simplifies the process of calculating certain categories of financial data. The major two functions of composing an account ledger are that it productively stores and organizes the company’s financial data and is effectively used to generate company’s financial statements in a perceptible form. This makes the accounts data for a company easy to analyze and interpret. A trial balance statement is usually formulated before a final financial statement is generated and depicts the overall transactions of the company for a certain period of time.

Importance of Account Ledger

Keeping an account ledger can harvest a number of benefits in regard to a company’s financial state. An account ledger gives an overview of all the company’s financial accounts, and it is easier to process as to which direction the cash is flowing. Since an account ledger assesses each transaction for its two-fold aspect therefore it enables a double-entry system to work proficiently. Record-keeping through an account ledger helps a third party analyze and assess the company’s financial position in case they are planning on buying the shares or investing in the company. Furthermore, it gives an idea of the net profit and loss for a fixed time period. The probability of error in accounts is low with an account ledger because the financial data is first entered into a journal and then later it is transferred to a ledger. That makes it a two-step process and removes the chances of errors and omissions in the financial data.

Benefits of Account Ledger

There are as many benefits of account ledger as anyone can image. These are given below for your ease;

1- Keeping an account ledger has saved millions of worth of credits for companies as it lets the management keep a look-out for the net balance and make necessary financial decisions right in time.

2- It gives access to the classified accounts which are usually not accessible prior to their entry into an account ledger.

3- The division of categories and sub-categories in an account ledger helps an organization keeps a transparent record of their credits and debits.

4- It also lets the employers or the owners ascertain the value and position of each department including their assets and liabilities.

5- It has clearly been stated about the importance of an account ledger that the success of an enterprise is majorly dependent on how well maintained its financial data is.

6- To conclude it precisely, an account ledger defines a company’s net worth and financial status.